Exhibit 99.1

IT’S MORE THAN A GAME.

DISCLAIMER Disclaimer This presentation is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to a proposed business combination (the “proposed business combination”) between PLAYSTUDIOS, Inc. (“PLAYSTUDIOS” or the “Company”) and Acies Acquisition Corp. (“Acies”) and related transactions (the “transactions”), and for no other purpose. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there by any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No representations or warranties, express or implied, are given in, or in respect of, this presentation. To the fullest extent permitted by law, in no circumstances will PLAYSTUDIOS, Acies or any of their respective subsidiaries, equityholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. Industry and market data used in this presentation have been obtained from third - party industry publications and sources as well as from research reports prepared for other purposes. Neither PLAYSTUDIOS nor Acies has independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to change. In addition, this presentation does not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of PLAYSTUDIOS or the proposed business combination. You are urged to make your own evaluation of PLAYSTUDIOS and such other investigations as you deem necessary before making an investment or voting decision. Forward Looking Statements This presentation and the related oral commentary include “forward - looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward - looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward - looking statements include, but are not limited to, statements regarding estimates and forecasts of financial and performance metrics, projections of market opportunity, total addressable market (TAM), market share and competition, expectations and timing related to commercial product launches, the potential success of PLAYSTUDIOS’ M&A strategy and the integration of those acquisitions, and expectations related to the terms and timing of the transactions. These statements are based on various assumptions, whether or not identified in this presentation, and on the current expectations of PLAYSTUDIOS’ and Acies’ management and are not predictions of actual performance. These forward - looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict, will differ from assumptions and are beyond the control of PLAYSTUDIOS and Acies. These forward - looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political and legal conditions; the inability of the parties to successfully or timely consummate the proposed business combination, including the risk that any required regulatory approvals are delayed or not obtained or that the approval of the shareholders of PLAYSTUDIOS or Acies is not obtained; failure to realize the anticipated benefits of the proposed business combination; future global, regional or local economic, political, market and social conditions, including due to the COVID - 19 pandemic; the development, effects and enforcement of laws and regulations, including with respect to the gaming industry; PLAYSTUDIOS’ ability to manage its future growth or to develop or acquire new games and make enhancements to its platform; the effects of competition on PLAYSTUDIOS’ future business; the amount of redemption requests made by Acies’ public shareholders; the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries; the ability to implement business plans, forecasts and other expectations after the completion of the proposed transaction and identify and realize additional opportunities; failure to realize anticipated benefits of the transaction or to realize estimated forecasts and projections; or other risks and uncertainties included in Acies’ or the Company's other filings with the U.S. Securities and Exchange Commission ("SEC"). The foregoing list of factors is not exclusive, and readers should also refer to those risks included under the heading “Risk Factors” in the registration statement on Form S - 4 (File No. 333 - 253135) containing the proxy statement/prospectus relating to the proposed business combination filed by Acies with the SEC and those included under the header “Risk Factors” in the final prospectus of Acies related to its initial public offering dated October 22, 2020, and those in other filings made by Acies or the Company with the SEC from time to time. You are cautioned not to place undue reliance upon any forward - looking statements in this presentation, which speak only as of the date made. PLAYSTUDIOS and Acies do not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward - looking statements in this presentation to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based.

DISCLAIMER (continued) Use of Projections This presentation contains projected financial information with respect to PLAYSTUDIOS, including revenue, cost of sales, user acquisition costs, other expenses and Adjusted EBITDA. Such projected financial information constitutes forward - looking information, is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such projected financial information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the projected financial information. See “Forward - Looking Statements” above. Actual results may differ materially from the results contemplated by the projected financial information contained in this presentation, and the inclusion of such information in this presentation should not be regarded as a representation by any person that the results reflected in such projections will be achieved. Neither the independent auditors of PLAYSTUDIOS or Acies audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. Financial Information; Non - GAAP Financial Measures The financial information and data contained in this presentation is unaudited and does not conform to the requirements of Regulation S - X. Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, any proxy statement, registration statement or prospectus to be filed by Acies with the SEC. In addition, all PLAYSTUDIOS historical financial information included herein is preliminary and subject to change, including in connection with the audit of the financial statements. Some of the financial information and data contained in this presentation, such as Adjusted EBITDA (AEBITDA), have not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). Adjusted EBITDA is defined as net income before interest, income taxes, depreciation and amortization and before costs capitalized for internal - use software projects, restructuring (consisting primarily of severance and other restructuring related costs), stock - based compensation expense, and other income and expense items (including unusual items, foreign currency gains and losses, and other non - cash items). PLAYSTUDIOS and Acies believe that the use of Adjusted EBITDA provides an additional tool to assess operational performance and trends in, and in comparing PLAYSTUDIOS’ financial measures with, other similar companies, many of which present similar non - GAAP financial measures to investors. PLAYSTUDIOS’ non - GAAP financial measures may be different from non - GAAP financial measures used by other companies. The presentation of non - GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial measures determined in accordance with GAAP. The principal limitation of Adjusted EBITDA is that it excludes significant expenses and income that are required by GAAP to be recorded in PLAYSTUDIOS’ financial statements. A reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure cannot be provided without unreasonable effort because of the inherent difficulty of accurately forecasting the occurrence and financial impact of the various adjusting items necessary for such reconciliations that have not yet occurred, are out of PLAYSTUDIOS’ control or cannot be reasonably predicted. For the same reasons, PLAYSTUDIOS is unable to provide probable significance of the unavailable information, which could be material to future results. Because of the limitations of non - GAAP financial measures, you should consider the non - GAAP financial measures presented in this presentation in conjunction with PLAYSTUDIOS’ audited financial statements and the related notes thereto. No Offer or Solicitation This presentation shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed transaction. This presentation shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

DISCLAIMER (continued) Additional Information In connection with the proposed business combination, Acies filed a registration statement on Form S - 4 with the SEC (File No. 333 - 253135) on February 16, 2021, which includes a proxy statement/prospectus, that will be both the proxy statement to be distributed to holders of Acies’ ordinary shares in connection with its solicitation of proxies for the vote by Acies’ shareholders with respect to the proposed business combination and other matters as may be described in the registration statement, as well as the prospectus relating to the offer and sale of the securities to be issued in the business combination. After the registration statement is declared effective, Acies will mail a definitive proxy statement/prospectus and other relevant documents to its stockholders. This document does not contain all the information that should be considered concerning the proposed business combination and is not intended to form the basis of any investment decision or any other decision in respect of the business combination. Acies’ shareholders, the Company’s stockholders and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus included in the registration statement and the amendments thereto and the definitive proxy statement/ prospectus and other documents filed in connection with the proposed business combination, as these materials will contain important information about the Company, Acies and the business combination. When available, the definitive proxy statement/prospectus and other relevant materials for the proposed business combination will be mailed to stockholders of Acies as of a record date to be established for voting on the proposed business combination. Acies’ shareholders and the Company’s stockholders will also be able to obtain copies of the proxy statement / prospectus and other documents filed with the SEC, without charge, once available, at the SEC’s website at www.sec.gov. INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. Participants in the Solicitation Acies and PLAYSTUDIOS and their respective directors and officers may be deemed participants in the solicitation of proxies of Acies’ shareholders in connection with the proposed business combination. A list of the names of such directors and executive officers and information regarding their interests in the business combination will be contained in the proxy statement/prospectus when available. You may obtain free copies of these documents as described in the preceding paragraph. Trademarks This presentation contains trademarks, service marks, trade names and copyrights of Acies, PLAYSTUDIOS and other companies, which are the property of their respective owners.

FINANCIAL OVERVIEW • Historical Performance - Annual - 2020 Quarterly - 2020 Metrics • Forecasted Performance - Annual - Operating Leverage - 2021 Q1 Metrics

FINANCIALS Sustained and projected top and bottom - line growth. (in 000's) Net Revenue Virtual Currency 157,114 193,849 231,726 268,137 97% 99% 97% 99% Advertising 4,688 356 383 1,745 3% 0% 0% 1% Other 134 1,294 7,312 0 0% 1% 3% 0% Total Net Revenue 161,936 195,499 239,421 269,882 YOY % 21% 22% 13% Expenses Cost of Sales 53,409 66,784 80,267 91,470 33% 34% 34% 34% User Acquisition 46,186 48,261 53,805 49,349 29% 25% 22% 18% All Other, Net 33,769 43 , 12 3 55,828 71 , 09 1 21% 22% 23% 26% 133,364 158,168 189,900 211,910 82% 81% 79% 79% AEBITDA before adjustment for the impact of capitalized software costs 28 , 572 37 , 331 49 , 521 57 , 972 18% 19% 21% 21% Impact of capitalized software costs (15,307) ( 20 , 844 ) (20,996) ( 25 , 154 ) - 9 % - 11 % - 9 % - 9 % AEBITDA 13,265 16 , 48 7 28,525 32 , 81 8 8% 8% 12% 12% YOY % 24% 73% 15% % of Revenue 2017 2018 2019 2020e Year Ended December 31 2017 2018 2019 2020e

A HISTORY OF REVENUE GROWTH Sustained network and consistently scaled revenues year - over - year. D AU Monthly Revenue D A U Revenue

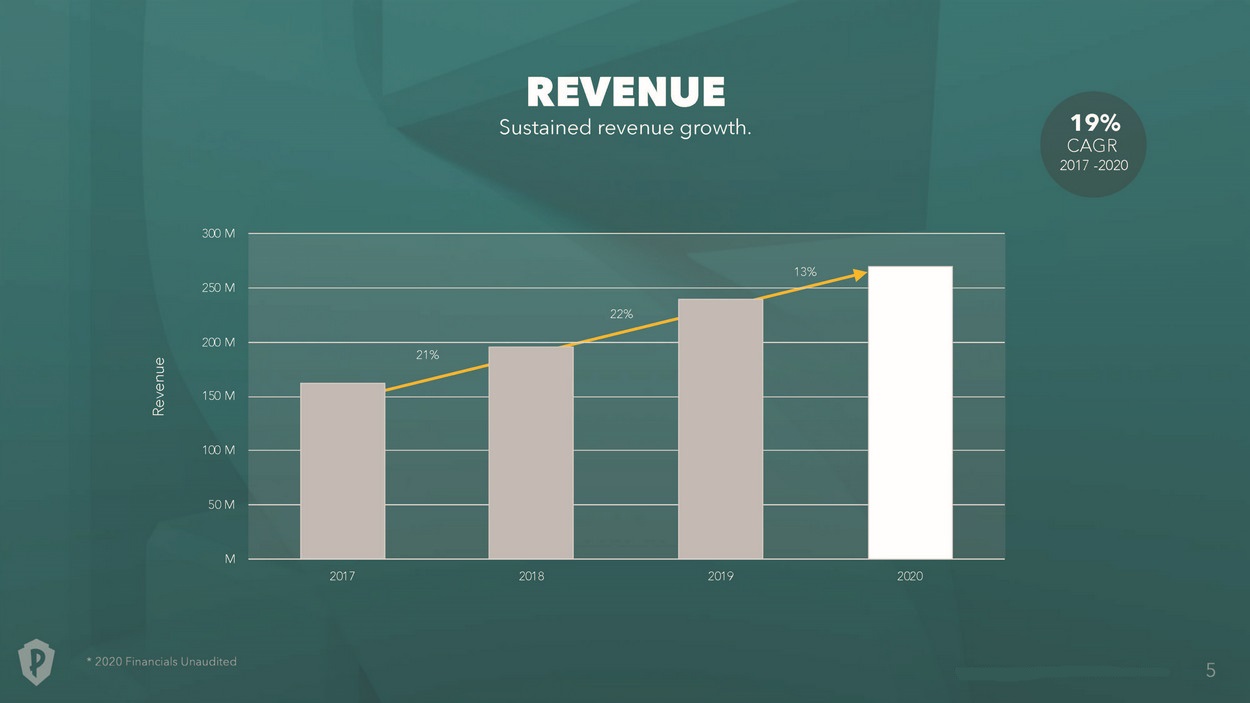

REVENUE Sustained revenue growth. Revenue M 50 M 100 M 150 M 200 M 250 M 300 M 2 0 17 2 0 18 2 0 19 2 0 20 13% 22% 21% 19% CAGR 2017 - 2020

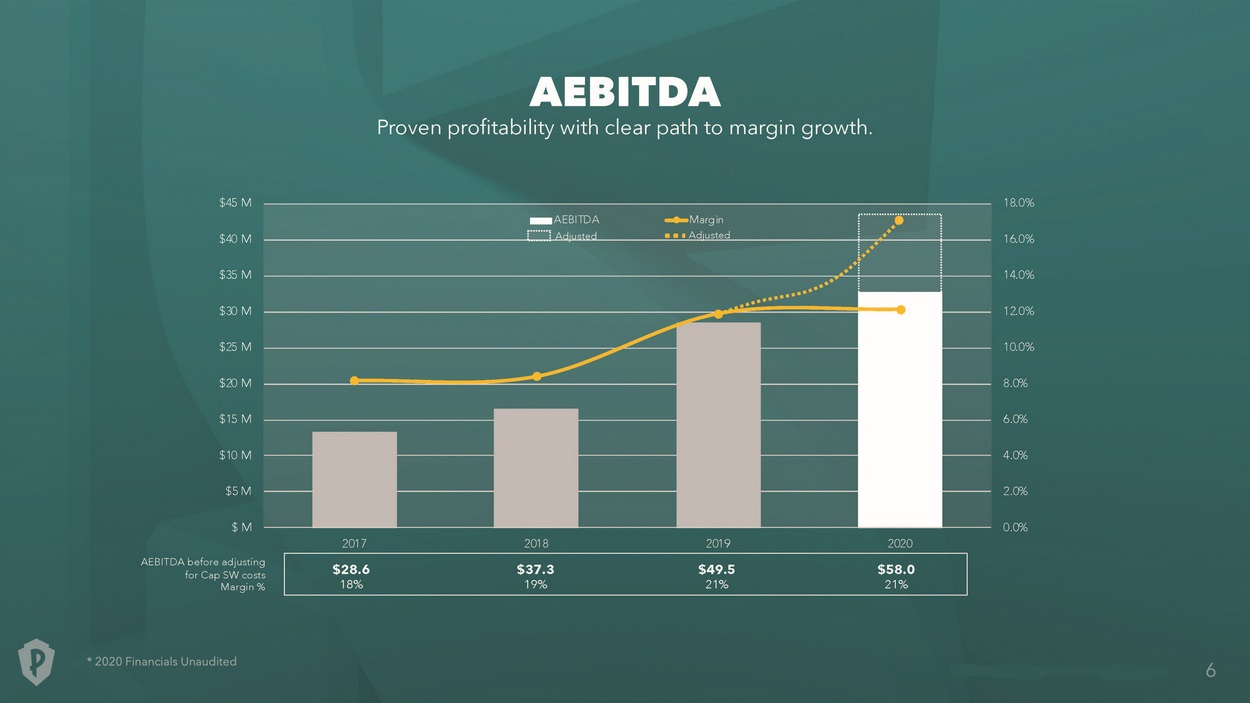

0. 0 % 2. 0 % 4. 0 % 6. 0 % 8. 0 % 1 0 . 0 % 1 2 . 0 % 1 4 . 0 % 1 6 . 0 % 1 8 . 0 % $ M $5 M $10 M $15 M $20 M $25 M $30 M $35 M $40 M $45 M AEBITDA Proven profitability with clear path to margin growth. Margin A d j u s t e d A E B I T D A Adjusted AEBITDA before adjusting for Cap SW costs Margin % 2017 $28 .6 18% 2018 $37 .3 19% 2019 $49 .5 21% 2020 $58 .0 21%

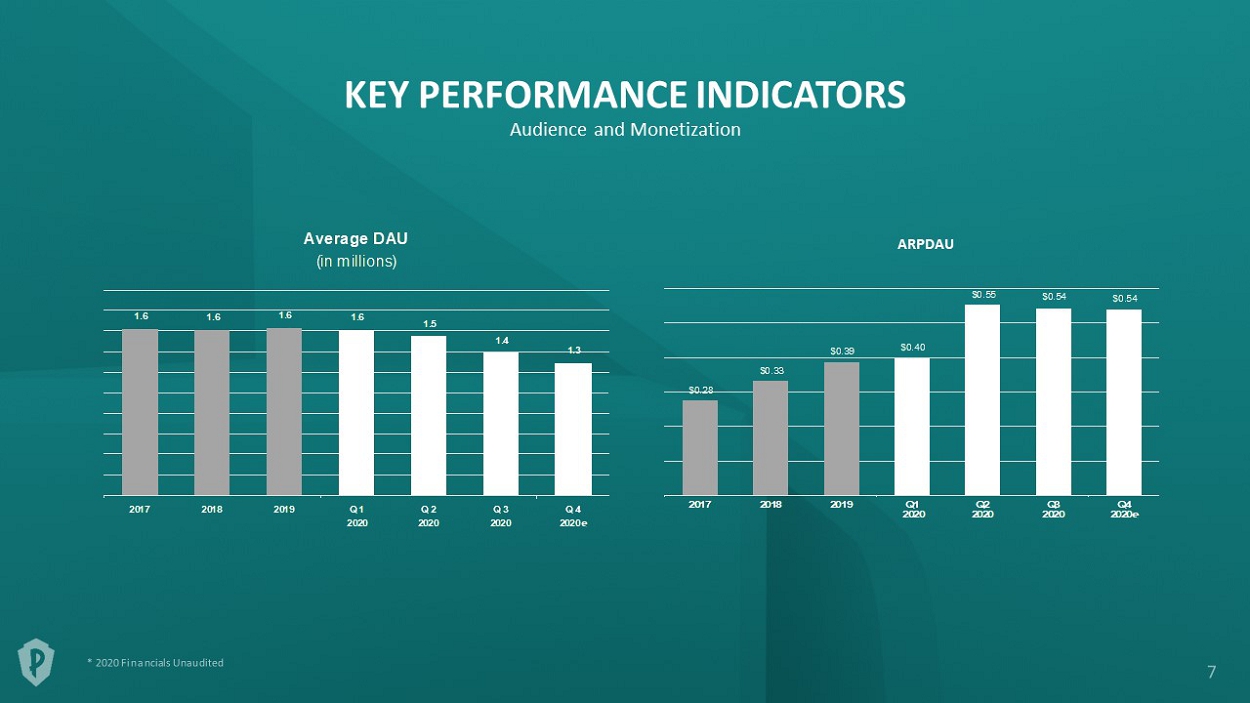

$0.33 $0.28 $0.39 $0.40 $0.55 $0.54 $0.54 2017 2018 2019 Q1 Q2 Q3 Q4 2020 2020 2020 2020e 1.6 1.6 1.6 1.6 1.5 1.4 1.3 2017 2018 2019 Q1 Q2 Q3 Q4 2020 2020 2020 2020e Average DAU (in millions) KEY PERFORMANCE INDICATORS Audience and Monetization

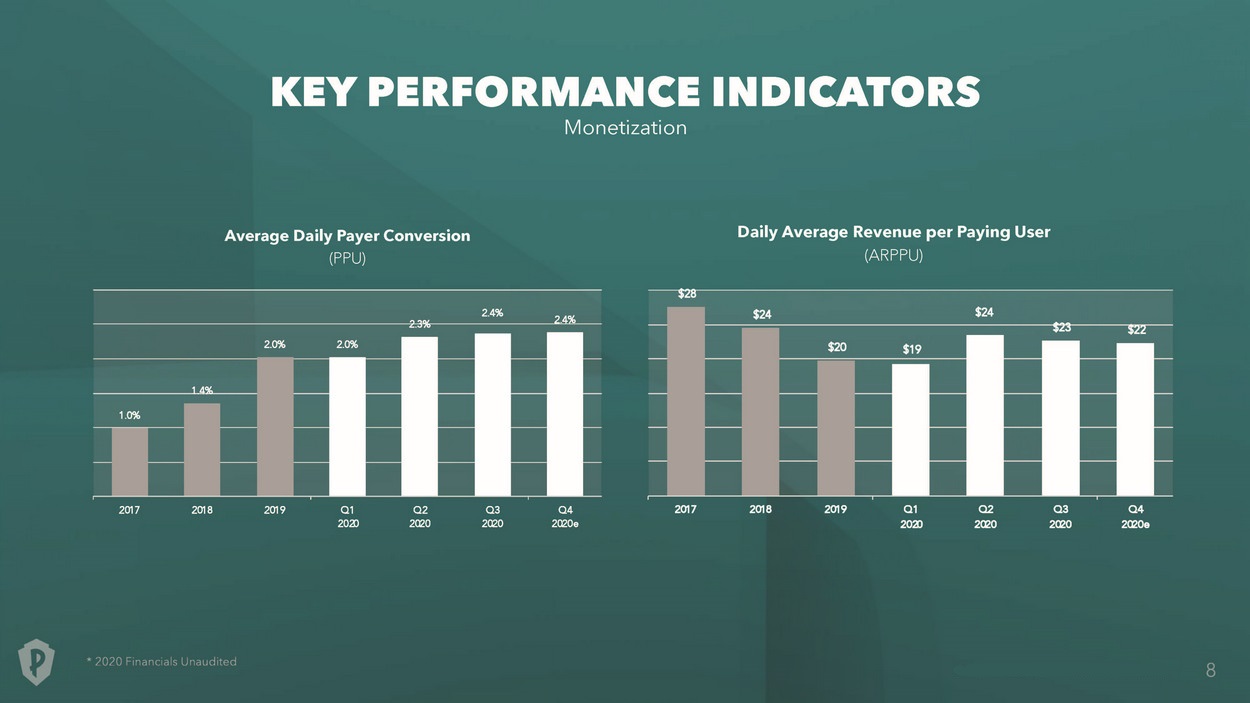

1.0% 1.4% 2.0% 2.0% 2.3% 2.4% 2.4% Average Daily Payer Conversion (PPU) $28 $24 $20 $19 $24 $23 $22 2017 2018 2019 Q1 Q2 Q3 Q4 2017 2018 2019 Q1 Q2 Q3 Q4 2020 2020 2020 2020e 2020 2020 2020 2 0 20e Daily Average Revenue per Paying User (ARPPU) KEY PERFORMANCE INDICATORS Monetization

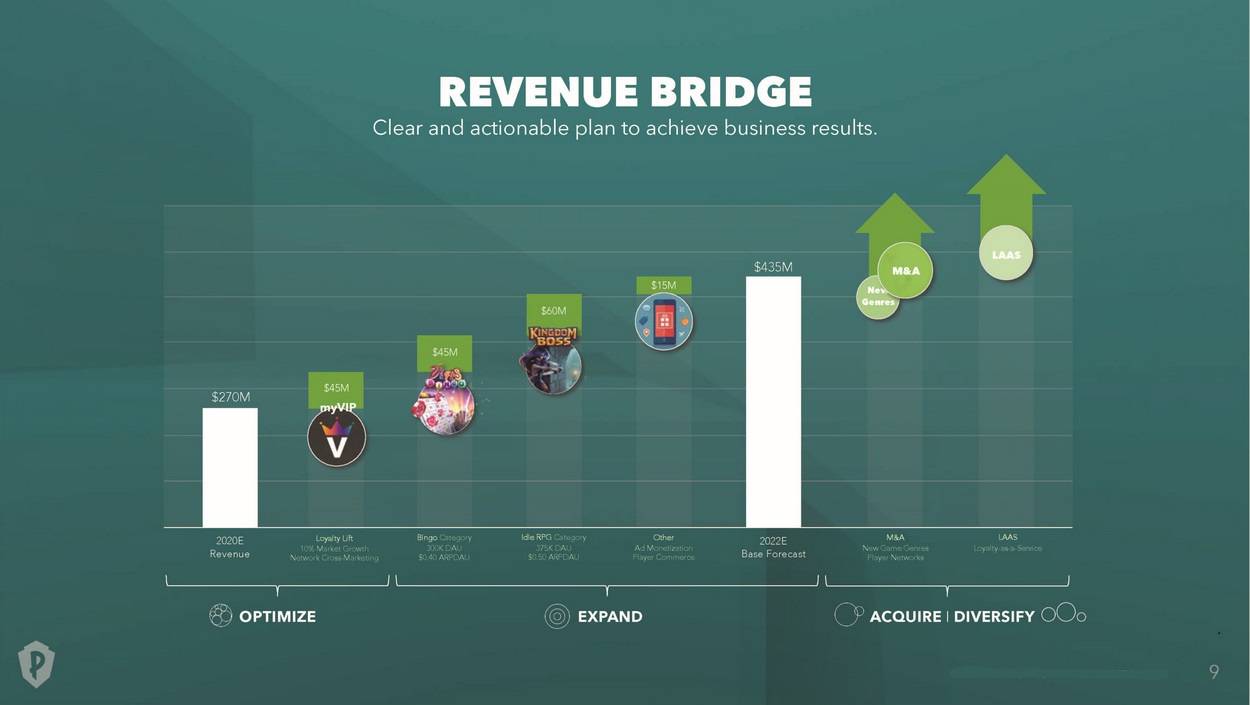

REVENUE BRIDGE Clear and actionable plan to achieve business results. Loyalty Lift 10% Market Growth Network Cross - Marketing Bingo Category 300K DAU $0.40 ARPDAU Idle RPG Category 375K DAU $0.50 ARPDAU $270M $435M 2020E Revenue 2022E Base Forecast M&A New Game Genres Player Networks $45M $60M EXPAND O P T I M I Z E Other Ad Monetization Player Commerce $15M ACQUIRE I DIVERSIFY $45M myVIP New G e n r e s L A A S M & A LAAS Loyalty - as - a - Service

500 M 450 M 400 M 350 M 300 M 250 M 200 M 150 M 100 M 50 M M 2 0 17 2 0 18 2 0 19 2 0 20 2 0 21 2 0 22 33% 22% 13% 22% 21% Revenue REVENUE Sustained and projected revenue growth.

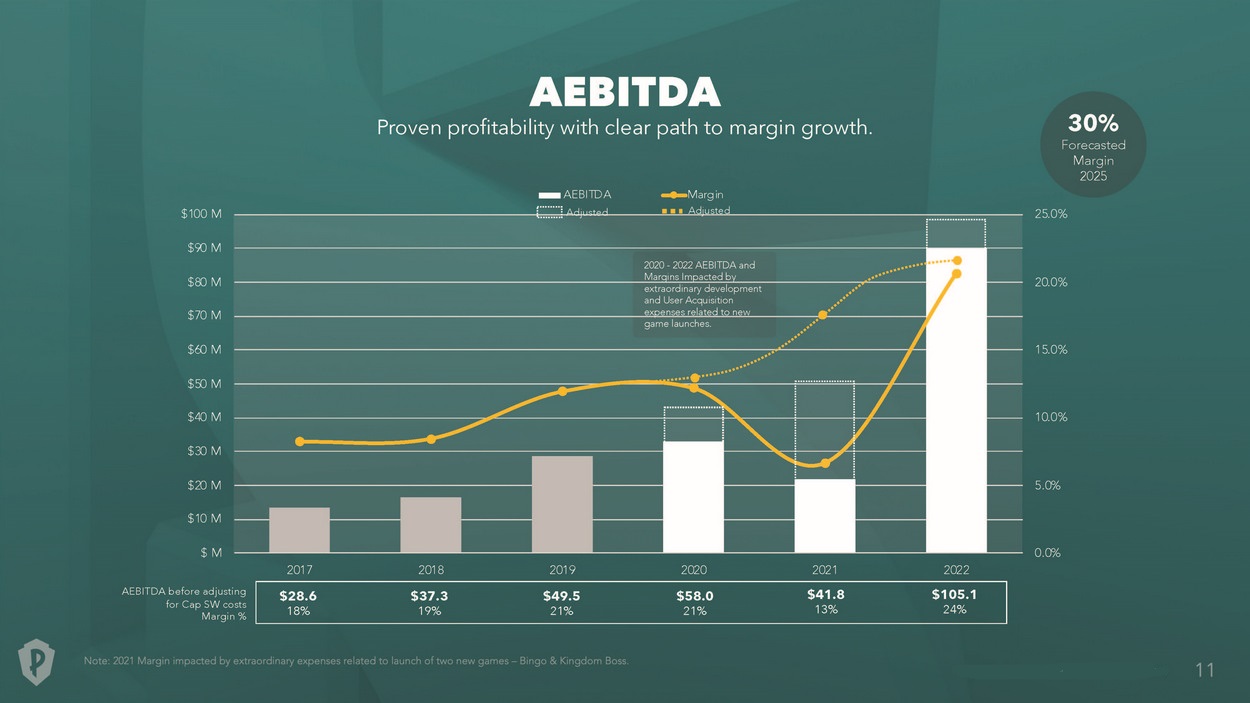

2020 - 2022 AEBITDA and Margins Impacted by extraordinary development and User Acquisition expenses related to new game launches. AEBITDA Proven profitability with clear path to margin growth. 0 . 0 % 5 . 0 % 1 0 . 0 % 1 5 . 0 % 2 0 . 0 % 2 5 . 0 % $ M $10 M $20 M $30 M $40 M $50 M $60 M $70 M $80 M $90 M $100 M 30% F o r ec a s t ed Margin 2025 Margin A d j u s t e d AEBITDA Adjusted AEBITDA before adjusting for Cap SW costs Margin % 2017 $28 .6 18% 2021 $41 .8 13% 2022 $105 .1 24% 2018 $37 .3 19% 2019 $49 .5 21% 2020 $58 .0 21%

20.7% 2.6% 1.8% 2.6% 1.5% 3.2% 0% 5% 12.0% 10% 1 5 % 2 0 % 2 5 % 3 0 % CY20 Margin Core Bus Op Ex E Commerce Ad Mon Corp Expenses New Games Post Launch CY22 Margin UA Efficiency Op Ex Efficiency CY23 Margin MARGIN Clear path to margin growth. 2.0% - 2.5% 2.5% - 3.0% 25% - 26% 30% F o r ec a s t ed Margin 2025 AEBITDA Margin % (before adjusting for SW CAP) 21 .5 % 24 .2 % 29% - 30%

21% 25% 30% 36% 35% 32% 32% 25% LTM EBITDA Margin % as of September 30, 2020 1 Median: 32% (Excl. PLAYSTUDIOS) PLAYSTUDIOS PLAYSTUDIOS PLAYSTUDIOS Playtika 2 Double Down 2, 3 Aristocrat 4 SciPlay 2 Zynga 2, 5 2022E Forecast 2023E Forecast 2025E Forecasted Interactive 30% F o r ec a s t ed Margin 2025 AEBITDA MARGIN Future Target In Line with Our Peers

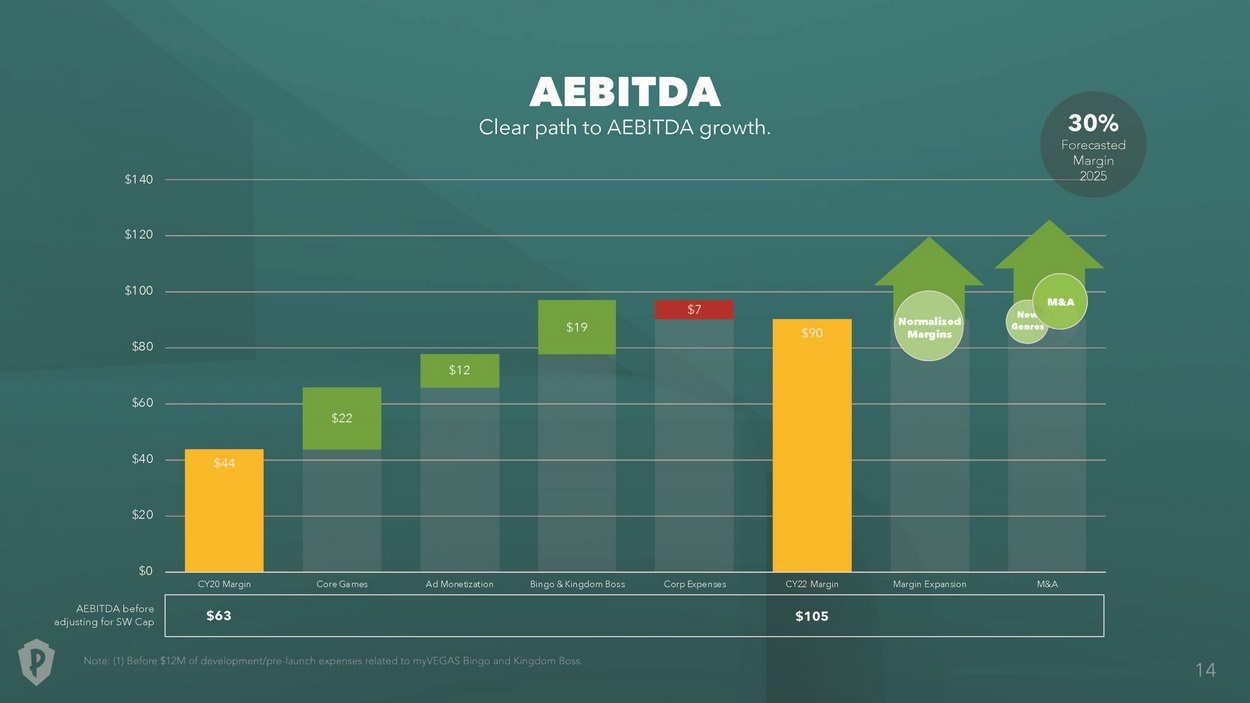

$44 $90 $22 $12 $19 $7 $0 $ 2 0 $ 4 0 $ 6 0 $ 8 0 $ 1 00 $ 1 20 $ 1 40 CY20 Margin Core Games Ad Monetization Bingo & Kingdom Boss Corp Expenses CY22 Margin Margin Expansion M & A A E B I T D A Clear path to AEBITDA growth. Margin 2025 30% Forecasted N or m a l iz e d Margins Genres M & A New AEBITDA before adjusting for SW Cap $63 $105

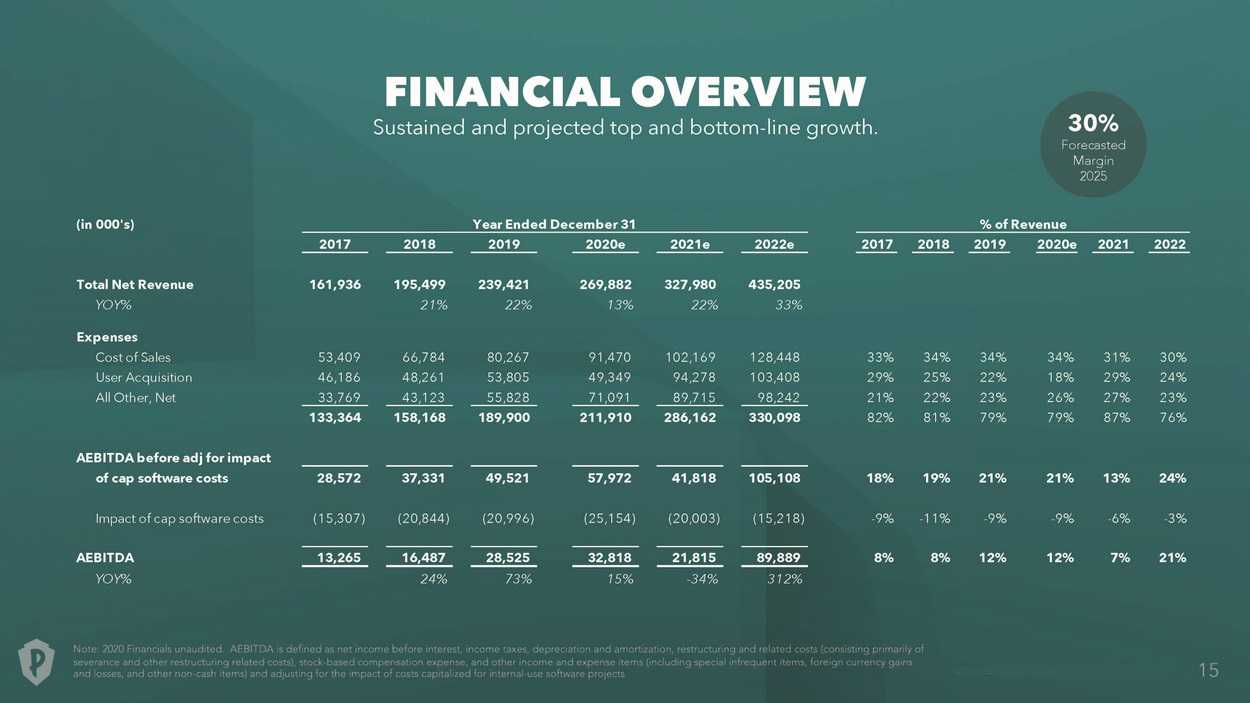

(in 000's) Year Ende d Dec ember 31 % of Revenue 2017 2018 2019 2020e 2021e 2022e 201 7 2018 201 9 2020e Total Net Revenue 161,936 195,499 239,421 269,882 327,980 435,205 YOY% 21% 22% 13% 22% 33% Expenses Cost of Sales 53,409 66 , 784 80,267 91,470 102,169 128,448 33% 34% 34% 34% User Acquisition 46,186 48 , 261 53,805 49,349 94,278 103,408 29% 25% 22% 18% All Other, Net 33 , 76 9 43 , 12 3 55 , 82 8 71,091 89 , 71 5 98 , 24 2 21% 22% 23% 26% 133,364 158 , 168 189,900 211,910 286,162 330,098 82% 81% 79% 79% AEBITDA before adj for impact of cap software costs 28,572 37 , 331 49,521 57,972 41,818 105,108 18% 19% 21% 21% Impact of cap software costs ( 15 , 307 ) ( 20 , 844 ) (20,996) (25,154) ( 20 , 003 ) (15,218) - 9 % - 11% - 9 % - 9 % AEBITDA 13 , 26 5 16 , 48 7 28 , 52 5 32,818 21 , 81 5 89 , 88 9 8% 8% 12% 12% YOY% 24% 73% 15% - 34 % 312% FINANCIAL OVERVIEW Sustained and projected top and bottom - line growth. 30% F o r ec a s t ed Margin 2025

GUIDANCE • 2021 - Reward engagement expected to recover & grow as travel restrictions are loosened and partners look to reinvigorate their businesses - Core games expected to grow in line with the social casino market - New game launches in Q1 and Q3 expected to grow audience and revenue - User Acquisition investments related to new games will compress AEBITDA in 2021 • 2022 - New games continue to scale driving increased audience and revenue - Reward engagement expected to reach, if not exceed, pre - COVID levels - Core games expected to continue to grow in line with social casino market - Margins expected to improve as new games normalize, and ad monetization and e - commerce continue to grow • M&A and Loyalty - as - a - Service impact excluded from forecasts

AT TA C H M E N T S

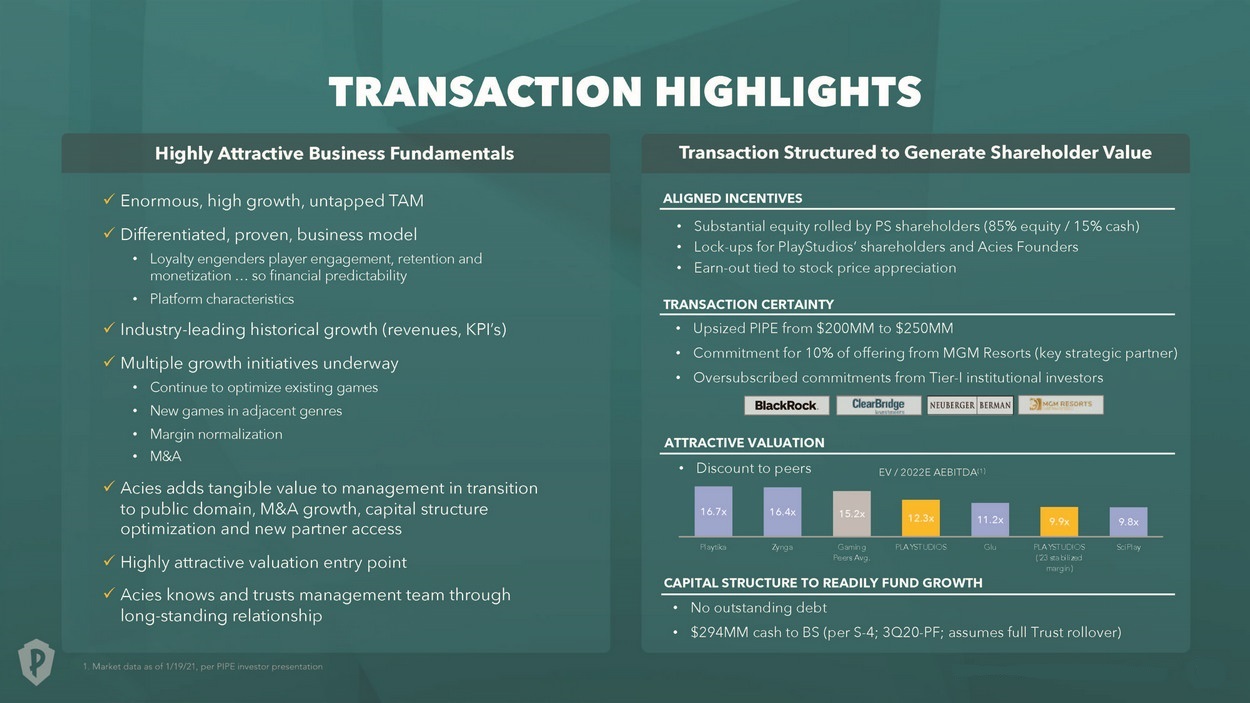

16.7x 16.4x 15.2x 12.3x 11.2x 9.9x 9.8x Pl aytika Z y n g a Gaming Pe ers Avg. PLA YSTUDIOS G l u PLA YSTUDIOS ('23 sta bilized margin ) Sci Play EV / 2022E AEBITDA (1) TRANSACTION HIGHLIGHTS x Enormous, high growth, untapped TAM x Differentiated, proven, business model • Loyalty engenders player engagement, retention and monetization … so financial predictability • Platform characteristics x Industry - leading historical growth (revenues, KPI’s) x Multiple growth initiatives underway • Continue to optimize existing games • New games in adjacent genres • Margin normalization • M&A x Acies adds tangible value to management in transition to public domain, M&A growth, capital structure optimization and new partner access x Highly attractive valuation entry point x Acies knows and trusts management team through long - standing relationship Highly Attractive Business Fundamentals Transaction Structured to Generate Shareholder Value ALIGNED INCENTIVES • Substantial equity rolled by PS shareholders (85% equity / 15% cash) • Lock - ups for PlayStudios’ shareholders and Acies Founders • Earn - out tied to stock price appreciation TRANSACTION CERTAINTY • Upsized PIPE from $200MM to $250MM • Commitment for 10% of offering from MGM Resorts (key strategic partner) • Oversubscribed commitments from Tier - I institutional investors • Discount to peers ATTRACTIVE VALUATION CAPITAL STRUCTURE TO READILY FUND GROWTH • No outstanding debt • $294MM cash to BS (per S - 4; 3Q20 - PF; assumes full Trust rollover)

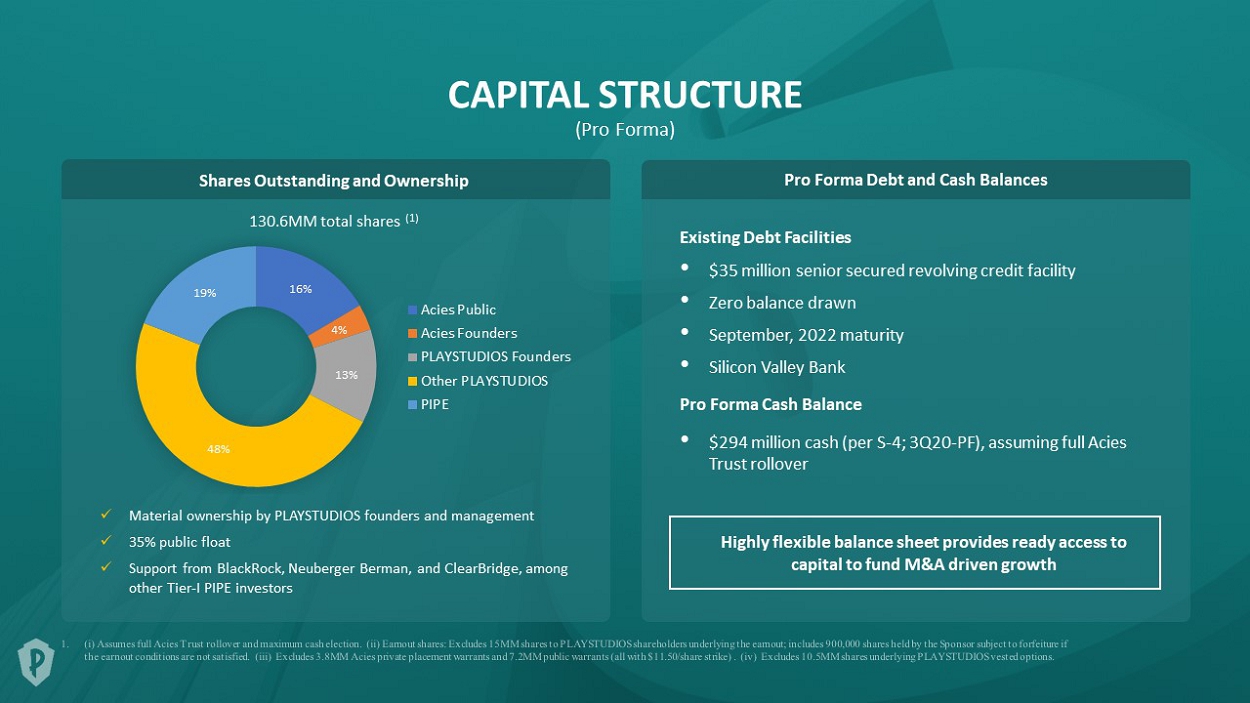

CAPITAL STRUCTURE (Pro Forma) 16% 4% 13% 48% 19% Acies Public Acies Founders PLAYSTUDIOS Founders Other PLAYSTUDIOS PIPE x Material ownership by PLAYSTUDIOS founders and management x 35% public float x Support from Blackrock, Neuberger Berman, and Clearbridge, among other Tier - I PIPE investors Shares Outstanding and Ownership Pro Forma Debt and Cash Balances 130.6MM total shares (1) Existing Debt Facilities • $35 million senior secured revolving credit facility • Zero balance drawn • September, 2022 maturity • Silicon Valley Bank Pro Forma Cash Balance • $294 million cash (per S - 4; 3Q20 - PF), assuming full Acies Trust rollover Highly flexible balance sheet provides ready access to capital to fund M&A driven growth

IT’S MORE THAN A GAME.