CONFIDENTIAL PLAYSTUDIOS Acquisition of Brainium Studios, LLC October 13, 2022

DISCLAIMER Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including statements regarding the company’s acquisition of Brainium, its games, daily active users and monthly active users of the Brainium games, the financial performance of Brainium, integrating Brainium into PLAYSTUDIOS, the anticipated or expected impact of acquiring Brainium, its financial performance and expected benefits. The company’s actual results may differ from their expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events or results. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside the company’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: the company’s ability to integrate Brainium and its employees into its operations; the company’s reliance on the employees of Brainium to continue to operate and develop its games; the company’s ability to maintain and grow the number of users of Brainium’s games; the impact of offering rewards to users of Brainium’s games; the company’s ability to monetize the Brainium games; the company’s ability to execute its business plan for the integration of Brainium and its games; general economic, business, and/or competitive factors; and other risks and uncertainties included from time to time in the company’s other filings with the U.S. Securities and Exchange Commission (the “SEC”). Additional information will be made available in other filings that the company makes from time to time with the SEC. In addition, any forward-looking statements contained in this presentation are based on assumptions that the company believes to be reasonable as of this date. The company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this presentation or to reflect new information or the occurrence of unanticipated events, except as required by law. Projected Non-GAAP Financial Measures PLAYSTUDIOS uses certain non-GAAP financial measures to analyze underlying business performance and trends. This presentation includes projected Adjusted Earnings per Share (or “Adjusted EPS”), a non-GAAP financial measure used to illustrate Brainium’s projected financial performance for the year ending December 31, 2022. PLAYSTUDIOS believes the presentation of Brainium’s projected Adjusted EPS provides useful information to investors and management in analyzing and benchmarking the financial performance and value of Brainium’s business. Non-GAAP financial measures should not be considered a substitute for, or superior to, financial measures determined or calculated in accordance with GAAP. PLAYSTUDIOS’ definitions of its non-GAAP financial measures may not be comparable to similarly titled measures reported by other companies. Brainium’s Adjusted EPS is calculated by dividing Branium’s projected Adjusted Net Income by PLAYSTUDIOS’ projected weighted average shares outstanding for the year ending December 31, 2022. We define Adjusted Net Income as net income (loss) adjusted to exclude depreciation and amortization related to the step-up in basis for the fair value of acquired tangible and intangible assets in accordance with Accounting Standards Codification Topic 805, acquisition-related costs, stock-based compensation expense, and other one-time non-operating income and expense items (including changes in market value of investments and other non-cash items). We also estimate PLAYSTUDIOS’ projected weighted average shares outstanding for the year ending December 31, 2022, and that estimate is used to calculate Brainium’s projected Adjusted EPS as described above. Brainium’s projected 2022 Adjusted EBITDA and Adjusted EPS, and PLAYSTUDIOS’ projected 2022 Adjusted EBITDA, and any other projected or forecast financial information contained or referenced in this presentation are merely estimates and constitute forward-looking statements as described above. We and Brainium have made a number of assumptions in preparing these projections, which may or may not prove to be correct. The projected Adjusted EBITDA and Adjusted EPS amounts and other projected or forecast financial information contained herein are subject to various risks and uncertainties, and do not guarantee actual results for the periods indicated. Factors, risks and uncertainties that could cause actual results to differ materially from those projected include those in the documents that we file with the SEC. We undertake no obligation to update or revise any of the projections contained in this presentation, whether as a result of new information, future developments, actual results, or otherwise. As there is uncertainty in connection with calculating the adjustments necessary to prepare reconciliations from the non-GAAP financial measures to the comparable GAAP financial measures, including the inability to calculate transaction-related items such as costs, gains/losses or potential asset impairments, PLAYSTUDIOS is unable to reconcile the non-GAAP financial measures without unreasonable efforts. Therefore, no reconciliation is being provided at this time. These items could result in significant adjustments from the most comparable GAAP measure.

DISCLAIMER (continued) Trademarks This presentation contains trademarks, service marks, trade names and copyrights of PLAYSTUDIOS and other companies, which are the property of their respective owners. Key Performance Indicators We manage our business by regularly reviewing several key operating metrics to track historical performance, identify trends in player activity, and set strategic goals for the future. Our key performance metrics are impacted by several factors that could cause them to fluctuate on a quarterly basis, such as platform providers’ policies, seasonality, player connectivity, and the addition of new content to games. We believe these measures are useful to investors for the same reasons. The key performance indicators may differ from similarly titled measures presented by other companies. For more information on our key performance indicators, please refer to the definitions below and the “Supplemental Data—Key Performance Indicators” in our SEC filings. Daily Active Users (“DAU”): DAU is defined as the number of individuals who played a game on a particular day. We track DAU by the player ID, which is assigned for each game installed by an individual. As such, an individual who plays two different PLAYSTUDIOS games on the same day is counted as two DAU while an individual who plays the same PLAYSTUDIOS game on two different devices is counted as one DAU. Brainium tracks DAU by app instance ID, which is assigned to each installation of a game on a particular device. As such, an individual who plays two different Brainium games on the same day is counted as two DAU while an individual who plays the same game on two different devices is counted as two DAU. For both PLAYSTUDIOS and Brainium, Average DAU is calculated as the average of the DAU for each day during the period presented. We use DAU as a measure of audience engagement to help us understand the size of the active player base engaged with our games on a daily basis. Monthly Active Users (“MAU”): MAU is defined as the number of individuals who played a game in a particular month. As with DAU, an individual who plays two different PLAYSTUDIOS games in the same month is counted as two MAU while an individual who plays the same game on two different devices is counted as one MAU, and an individual who plays two different Brainium games on the same day is counted as two MAU while an individual who plays the same game on two different devices is counted as two MAU. Average MAU is calculated as the average of MAU for each calendar month during the period presented. We use MAU as a measure of audience engagement to help us understand the size of the active player base engaged with our games on a monthly basis.

CONFIDENTIAL PLAYSTUDIOS Announces the Acquisition of Brainium

Meaningfully and immediately accretive to Adjusted EPS and AEBITDA margins Funded with cash on hand maintaining debt-free balance sheet Nearly doubles audience reach by adding 5.5M MAU and 2M loyal DAU Expands game portfolio into casual genre with rich suite of popular and engaging titles Diversifies revenue mix by adding meaningful amount of high margin ad revenue Opportunity to drive synergies across product, user acquisition, engagement and monetization KEY TRANSACTION HIGHLIGHTS Acquisition advances the company’s strategy by diversifying our game portfolio and bringing playAWARDS to a larger audience.

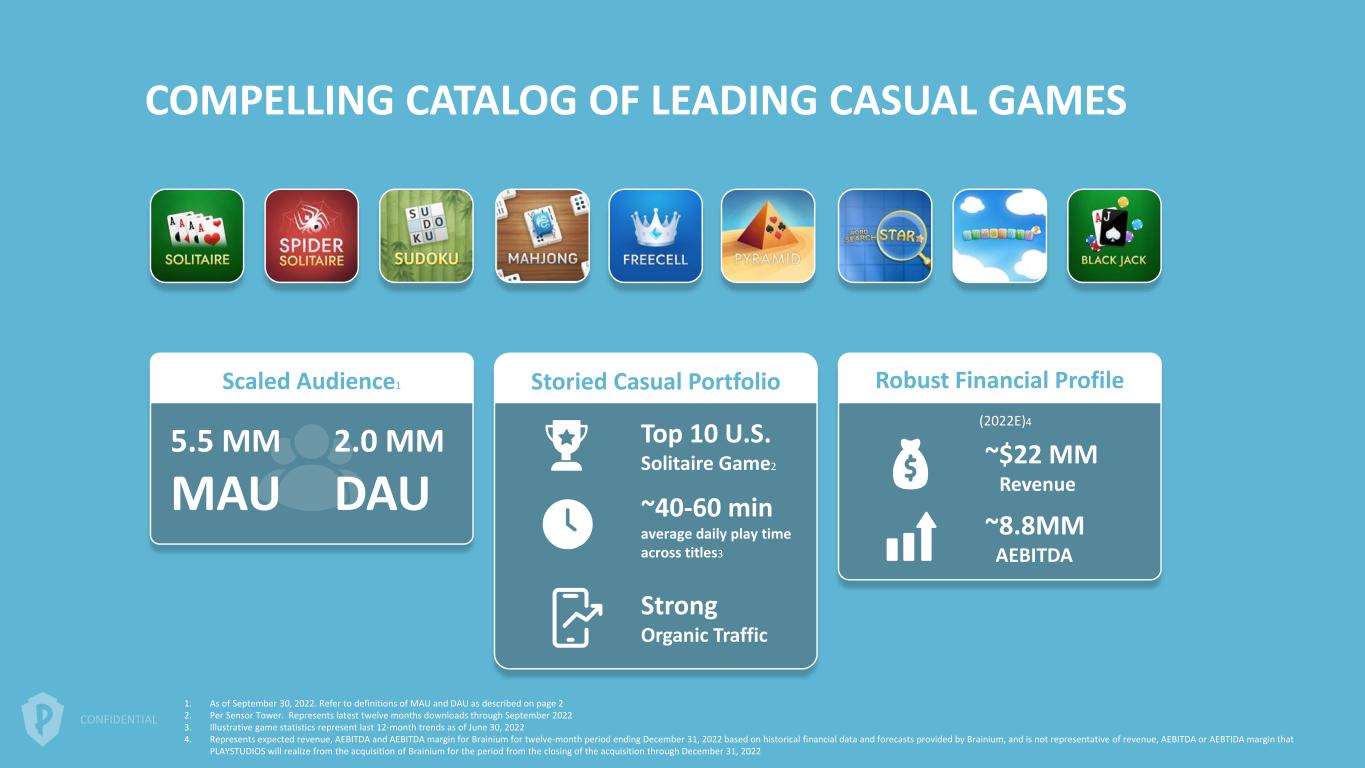

BRAINIUM STUDIOS OVERVIEW Brainium Studios (“Brainium”) is a Portland, OR based mobile game studio focused on developing and publishing casual games. Brainium has long-standing reputation for developing elegant, simple and deeply engaging games. High-quality team of 34 tenured game designers, engineers and operators. 2022E Revenue and AEBITDA expected to be $22mm and $8.8mm (~40% margin), respectively. Founded in 2008 and led by Scott Willoughby, a seasoned gaming executive with experience at Amazon and Microsoft.

1. As of September 30, 2022. Refer to definitions of MAU and DAU as described on page 2 2. Per Sensor Tower. Represents latest twelve months downloads through September 2022 3. Illustrative game statistics represent last 12-month trends as of June 30, 2022 4. Represents expected revenue, AEBITDA and AEBITDA margin for Brainium for twelve-month period ending December 31, 2022 based on historical financial data and forecasts provided by Brainium, and is not representative of revenue, AEBITDA or AEBTIDA margin that PLAYSTUDIOS will realize from the acquisition of Brainium for the period from the closing of the acquisition through December 31, 2022 Scaled Audience1 Storied Casual Portfolio 5.5 MM MAU 2.0 MM DAU Top 10 U.S. Solitaire Game2 ~40-60 min average daily play time across titles3 Strong Organic Traffic ~$22 MM Revenue ~8.8MM AEBITDA Robust Financial Profile COMPELLING CATALOG OF LEADING CASUAL GAMES (2022E)4

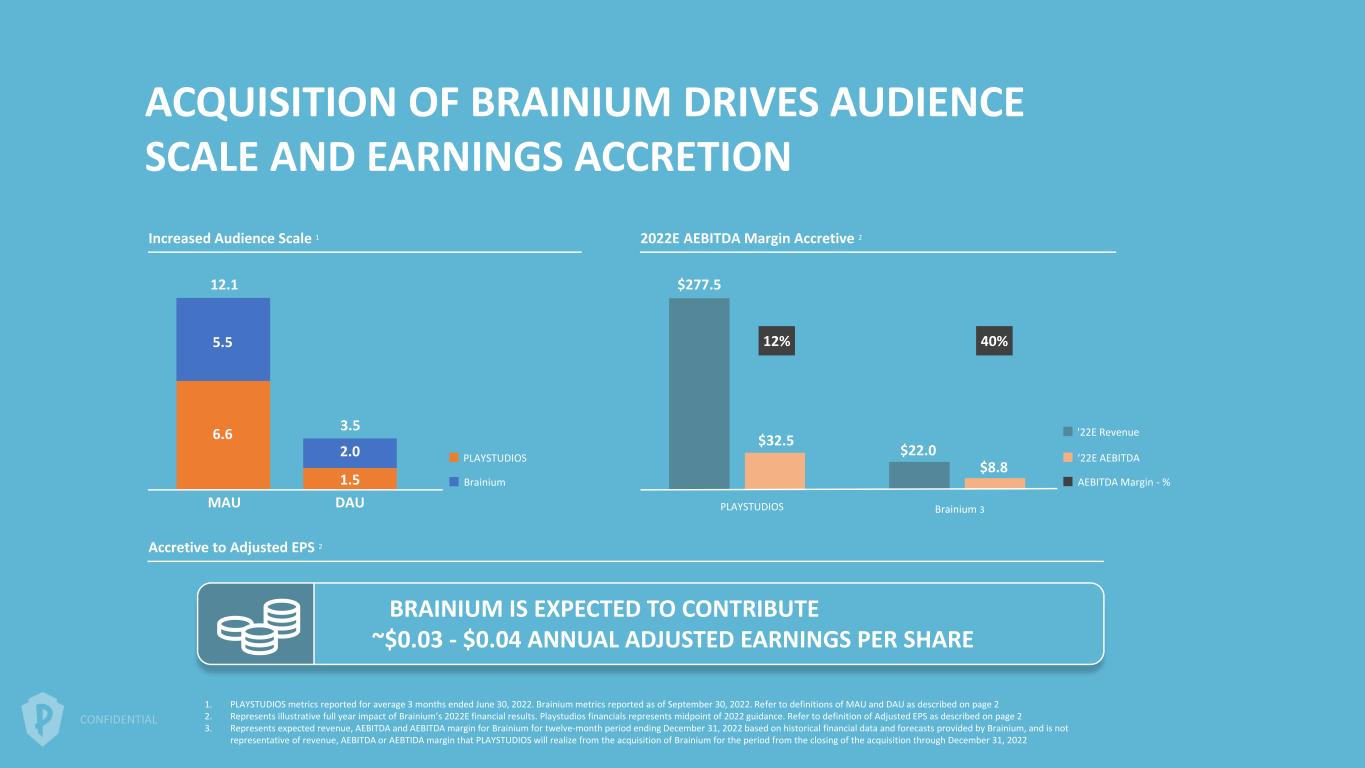

6.6 5.5 2.0 1.5 ACQUISITION OF BRAINIUM DRIVES AUDIENCE SCALE AND EARNINGS ACCRETION 1. PLAYSTUDIOS metrics reported for average 3 months ended June 30, 2022. Brainium metrics reported as of September 30, 2022. Refer to definitions of MAU and DAU as described on page 2 2. Represents illustrative full year impact of Brainium’s 2022E financial results. Playstudios financials represents midpoint of 2022 guidance. Refer to definition of Adjusted EPS as described on page 2 3. Represents expected revenue, AEBITDA and AEBITDA margin for Brainium for twelve-month period ending December 31, 2022 based on historical financial data and forecasts provided by Brainium, and is not representative of revenue, AEBITDA or AEBTIDA margin that PLAYSTUDIOS will realize from the acquisition of Brainium for the period from the closing of the acquisition through December 31, 2022 Accretive to Adjusted EPS 2 Increased Audience Scale 1 2022E AEBITDA Margin Accretive 2 BRAINIUM IS EXPECTED TO CONTRIBUTE ~$0.03 - $0.04 ANNUAL ADJUSTED EARNINGS PER SHARE MAU DAU 12.1 3.5 PLAYSTUDIOS Brainium PLAYSTUDIOS Brainium 3 ‘22E AEBITDA AEBITDA Margin - % $277.5 $32.5 $22.0 $8.8 '22E Revenue 12% 40%

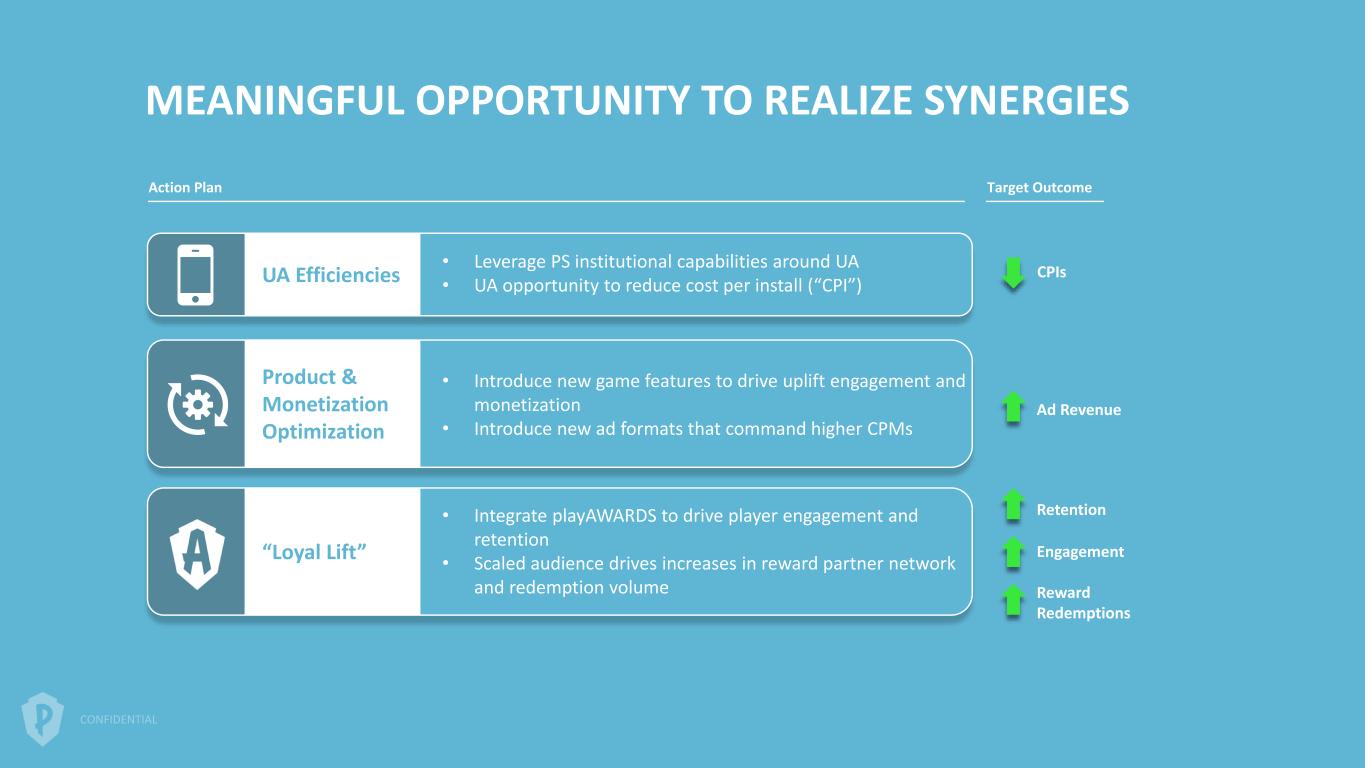

MEANINGFUL OPPORTUNITY TO REALIZE SYNERGIES Action Plan Target Outcome UA Efficiencies • Leverage PS institutional capabilities around UA • UA opportunity to reduce cost per install (“CPI”) Product & Monetization Optimization • Introduce new game features to drive uplift engagement and monetization • Introduce new ad formats that command higher CPMs “Loyal Lift” • Integrate playAWARDS to drive player engagement and retention • Scaled audience drives increases in reward partner network and redemption volume CPIs Ad Revenue Retention Engagement Reward Redemptions

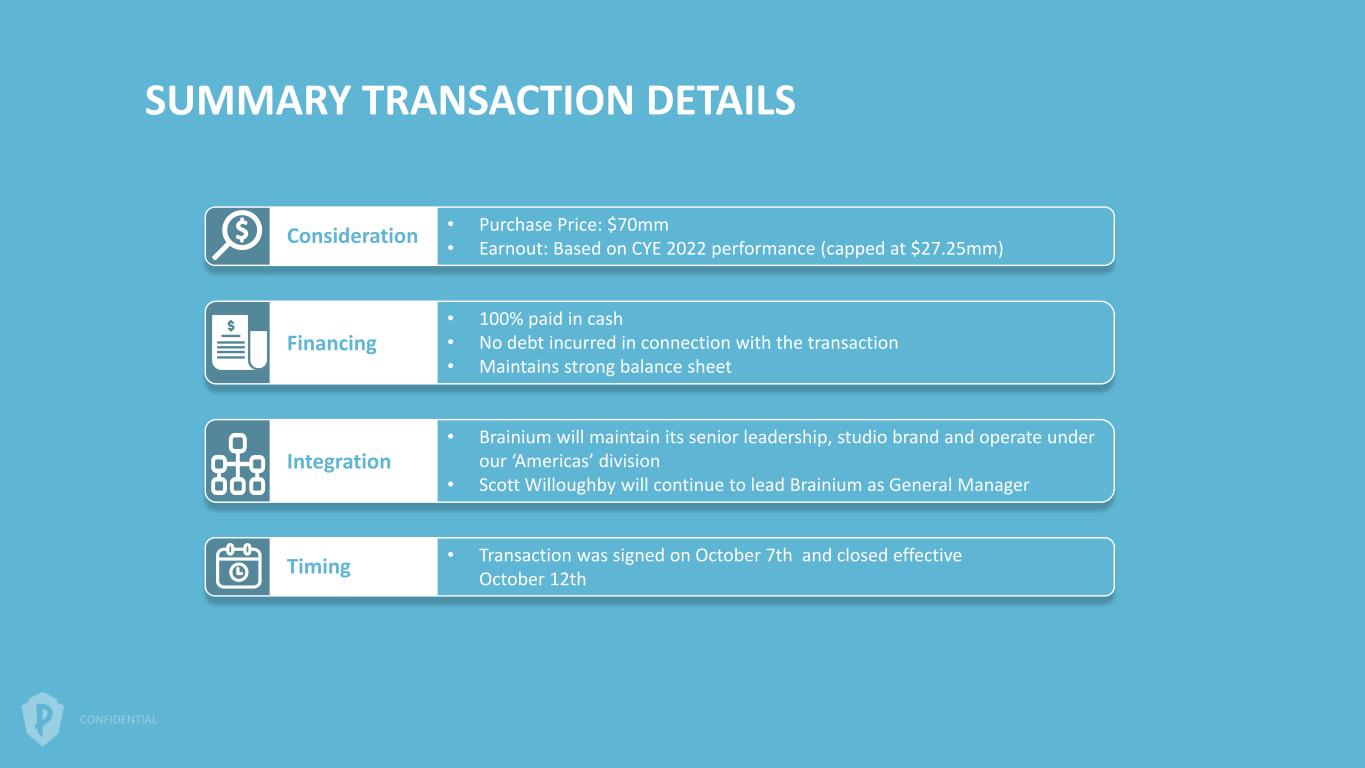

SUMMARY TRANSACTION DETAILS Consideration • Purchase Price: $70mm • Earnout: Based on CYE 2022 performance (capped at $27.25mm) Financing • 100% paid in cash • No debt incurred in connection with the transaction • Maintains strong balance sheet Integration • Brainium will maintain its senior leadership, studio brand and operate under our ‘Americas’ division • Scott Willoughby will continue to lead Brainium as General Manager Timing • Transaction was signed on October 7th and closed effective October 12th