Released: 08.03.2023 Investor Presentation

Confidential: Investor Presentation Released: 08.03.2023 Disclaimer Forward-Looking Statements This presentation contains forward-looking statements that relate to anticipated future events, including anticipated future operating results, business performance, and financial conditions. The company’s actual results may differ from the company’s current expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events or results. In some cases, forward-looking statements will be identified by words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “guidance,” “outlook,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions. These forward-looking statements are subject to risks, uncertainties and other factors that could cause the actual results to differ materially from those expressed or implied by such forward-looking statements. Most of these risks, uncertainties and other factors are outside the company’s control and are difficult to predict. Factors that could impact the company’s future performance and cause actual results to differ from the forward-looking statements contained in this presentation include, but are not limited to, risks and uncertainties identified from time to time in the company’s filings with the U.S. Securities and Exchange Commission (the “SEC”). In addition, forward-looking statements contained in this presentation are based on assumptions that the company believes to be reasonable as of this date. The company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this presentation or to reflect new information or the occurrence of unanticipated events, except as required by law. Unaudited and Non-GAAP Financial Measures This presentation contains financial data that is not audited and financial data that was not prepared in accordance with accounting principles generally accepted in the United States (“GAAP). PLAYSTUDIOS uses certain non-GAAP financial measures, including Adjusted EBITDA, to analyze underlying business performance and trends. The company believes the presentation of these non-GAAP financial measures provides useful information to investors and management in analyzing and benchmarking the financial and operating performance of the company’s business. Non-GAAP financial measures are not measures of financial performance determined in accordance with GAAP and should not be considered a substitute for, or superior to, financial measures determined or calculated in accordance with GAAP. The non-GAAP financial measures contained in this presentation are not meant to be considered in isolation or as a substitute for comparable GAAP measures and should be read in conjunction with PLAYSTUDIOS’ consolidated financial statements prepared in accordance with GAAP. In addition, non-GAAP measures contained in this presentation reflect the exercise of management’s judgment regarding which items are included or excluded in their determination, and as a result the company’s definitions of non-GAAP financial measures may not be comparable to similarly titled measures reported by other companies. Please refer to our SEC filings for reconciliation of the non-GAAP financial measures contained herein to the most directly comparable measures in accordance with GAAP. Key Performance Indicators We manage our business by regularly reviewing several key operating metrics to track historical performance, identify trends in player activity, and set strategic goals for the future. Our key performance metrics are impacted by several factors that could cause them to fluctuate on a quarterly basis, such as platform providers’ policies, seasonality, player connectivity, and the addition of new content to games. The key performance indicators may differ from similarly titled measures presented by other companies. For more information on our key performance indicators, please refer to the definitions and additional information contained in our SEC filings. Industry Data This presentation refers to, and in some cases relies upon, certain information, statistics and forecasts obtained from third-party sources. While the company believes such third-party sources to be reliable, the company has not independently verified the accuracy completeness of any such third-party data. This presentation contains trademarks, service marks, trade names and copyrights of PLAYSTUDIOS and other companies, which are the property of their respective owners.

Confidential: Investor Presentation Released: 08.03.2023 Samir Jain Treasury & Investor Relations PLAYSTUDIOS samir.jain@playstudios.com

Confidential: Investor Presentation Released: 08.03.2023 Rapidly Diversifying Game Portfolio Brainium acquisition and exclusive mobile rights for Tetris expected to contribute to growth in 2023. playAWARDS Loyalty Platform a Key Differentiator Loyalty program drives key metrics for connected games and global brand partners. Preparing to scale the platform by offering Loyalty-as- a-Service to third-party developers. Strong Leadership with Aligned Interests Numerous executives and board members are largest shareholders. CEO is 2nd largest shareholder. Sustained Growth and Strong Economics Double-digit, 10-year CAGR. Cash generative business with ~$128MM on hand, as of 6/30/2023. $50MM share repurchase authorization. $81MM available revolving credit line. Key Investment Highlights PLAYSTUDIOS at-a-glance

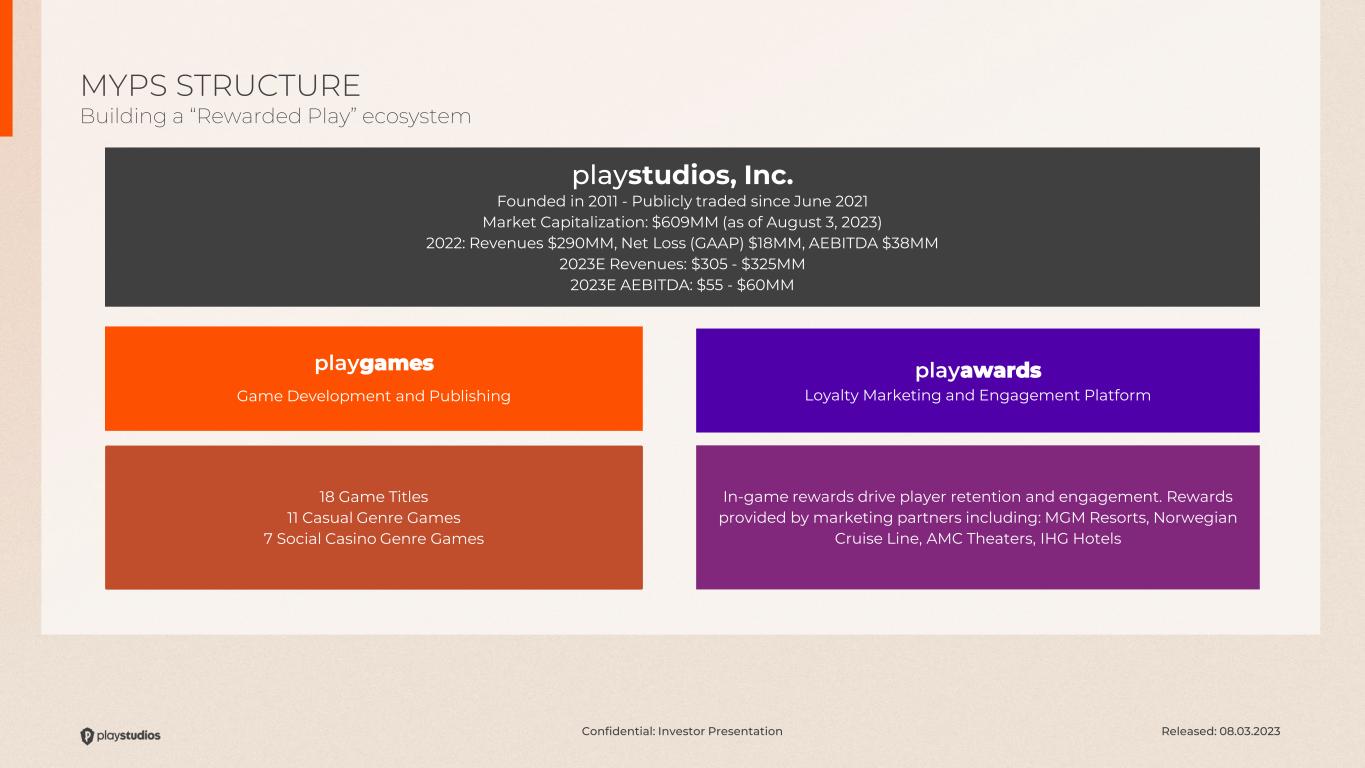

Confidential: Investor Presentation Released: 08.03.2023 MYPS STRUCTURE Building a “Rewarded Play” ecosystem playawards Loyalty Marketing and Engagement Platform In-game rewards drive player retention and engagement. Rewards provided by marketing partners including: MGM Resorts, Norwegian Cruise Line, AMC Theaters, IHG Hotels 18 Game Titles 11 Casual Genre Games 7 Social Casino Genre Games playgames Game Development and Publishing playstudios, Inc. Founded in 2011 - Publicly traded since June 2021 Market Capitalization: $609MM (as of August 3, 2023) 2022: Revenues $290MM, Net Loss (GAAP) $18MM, AEBITDA $38MM 2023E Revenues: $305 - $325MM 2023E AEBITDA: $55 - $60MM

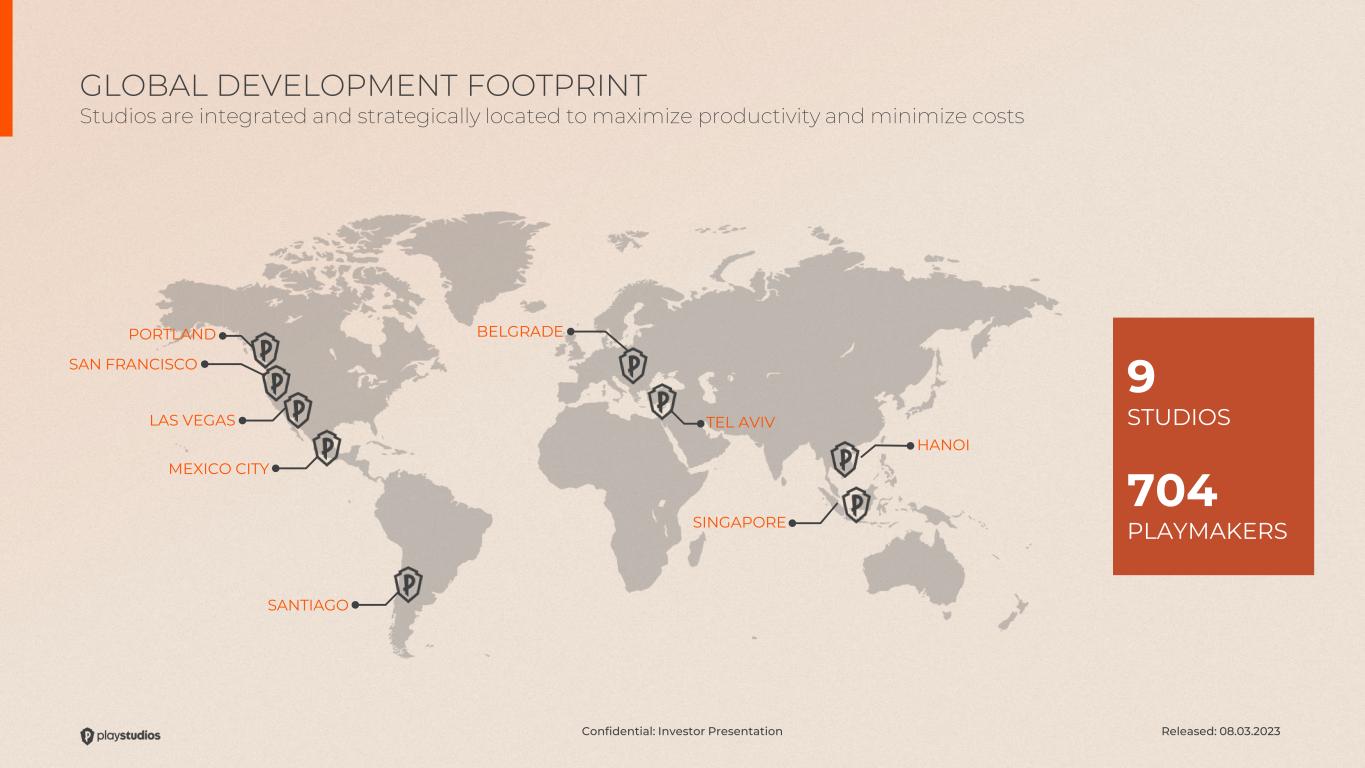

Confidential: Investor Presentation Released: 08.03.2023 SAN FRANCISCO LAS VEGAS BELGRADE TEL AVIV SINGAPORE HANOI 9 STUDIOS 704 PLAYMAKERS PORTLAND MEXICO CITY SANTIAGO GLOBAL DEVELOPMENT FOOTPRINT Studios are integrated and strategically located to maximize productivity and minimize costs

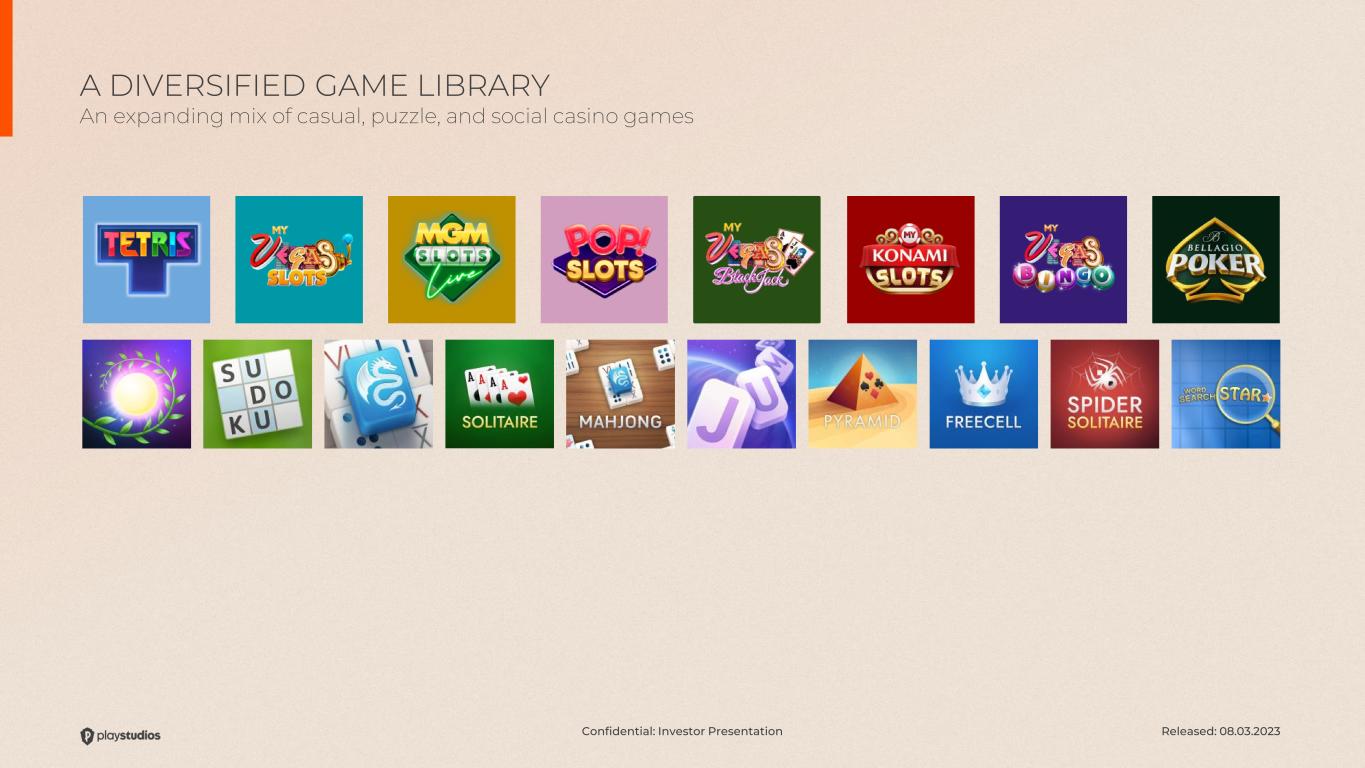

Confidential: Investor Presentation Released: 08.03.2023 A DIVERSIFIED GAME LIBRARY An expanding mix of casual, puzzle, and social casino games

Confidential: Investor Presentation Released: 08.03.2023 13 Million MAU 54% Female 46% Male 49 Average Age $80K Average Income 2.4 Sessions / Day 40 Minutes / Day 2.4 Million Reward Purchasers 15.8 Million Rewards Purchased *As of 6/30/2023 LEADING GLOBAL GAME DEVELOPER AND PUBLISHER We have a large, captive, and loyal audience of players

Released: 08.03.2023

Confidential: Investor Presentation Released: 08.03.2023 AUDIENCE ACQUISITION BECOMING MORE DIFFICULT The ability to launch and scale games is more challenging than ever Rising Costs Large audience networks and sophisticated AdTech platforms are commanding higher prices in response to demand for top performing ad inventory. Targeting Less Effective GDPR, Deprecation of IDFA, and implementation of GAID now limit an advertisers’ ability to efficiently target specific customer cohorts at scale. More Competition Growing competition for user attention across all forms of entertainment-games, social, streaming - makes it more difficult to hold an audience’s engagement.

Confidential: Investor Presentation Released: 08.03.2023 For apps and brands, retention of existing customers is now more important than ever.

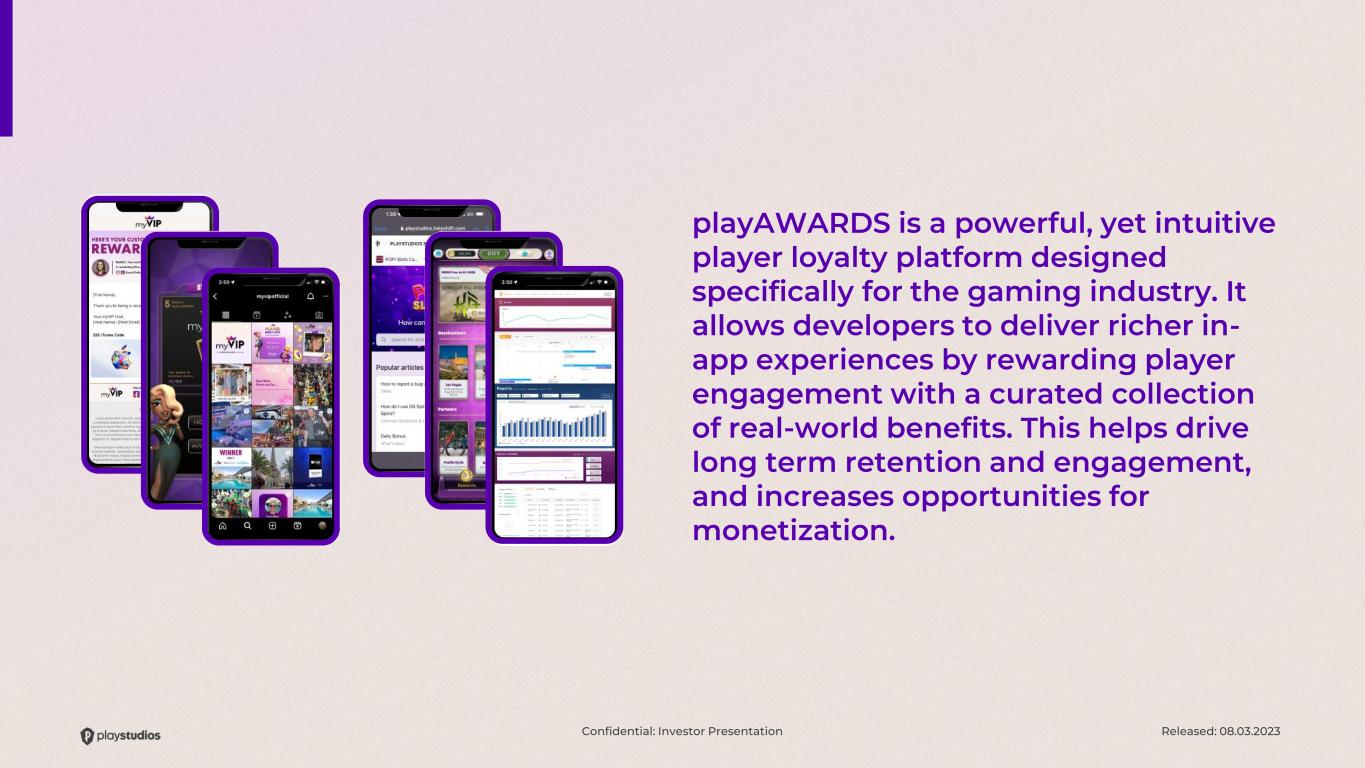

Confidential: Investor Presentation Released: 08.03.2023 playAWARDS is a powerful, yet intuitive player loyalty platform designed specifically for the gaming industry. It allows developers to deliver richer in- app experiences by rewarding player engagement with a curated collection of real-world benefits. This helps drive long term retention and engagement, and increases opportunities for monetization.

Confidential: Investor Presentation Released: 08.03.2023 Player Progression Tiers Players “chase” an increasingly valuable collection of in-game benefits, including elevated VIP Status. This type of progression mechanic is a proven driver of game engagement and retention. Rewards Marketplace By offering engaged players real- world rewards, they are more likely to remain within our PLAYSTUDIOS ecosystem. Loyalty Currency As players engage with our games, they accumulate a “loyalty currency” that can be exchanged for real-world rewards. This currency offers a measure of progress toward a gamified goal. VIP Services Our highest value players have access to dedicated VIP hosts who extend personalized service and tailored benefits. THE playAWARDS PLATFORM The building blocks of player retention and engagement

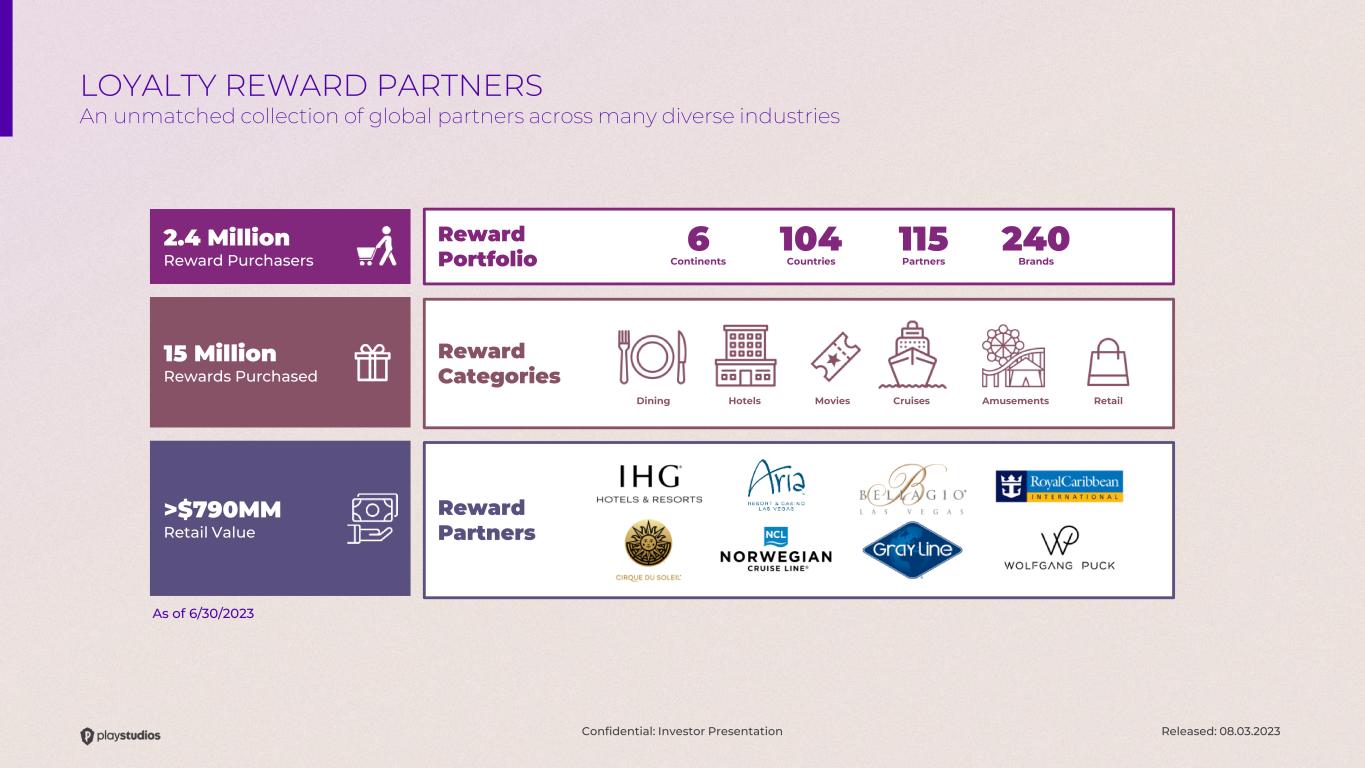

Confidential: Investor Presentation Released: 08.03.2023 Reward Partners 2.4 Million Reward Purchasers >$790MM Retail Value Reward Portfolio Reward Categories 15 Million Rewards Purchased 6 Continents 104 Countries 115 Partners 240 Brands Dining Hotels Movies Cruises Amusements Retail As of 6/30/2023 LOYALTY REWARD PARTNERS An unmatched collection of global partners across many diverse industries

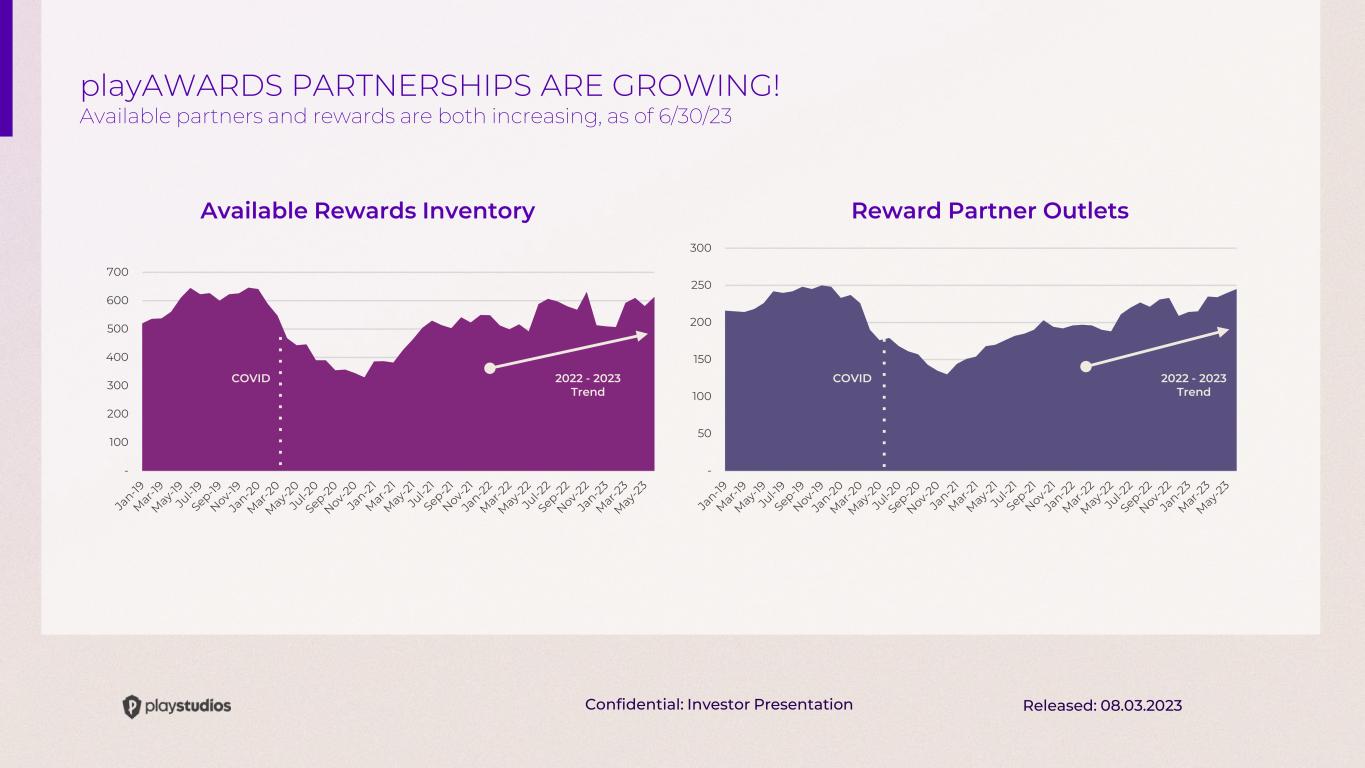

Confidential: Investor Presentation Released: 08.03.2023 - 50 100 150 200 250 300 - 100 200 300 400 500 600 700 Available Rewards Inventory Reward Partner Outlets COVID COVID2022 - 2023 Trend 2022 - 2023 Trend playAWARDS PARTNERSHIPS ARE GROWING! Available partners and rewards are both increasing, as of 6/30/23

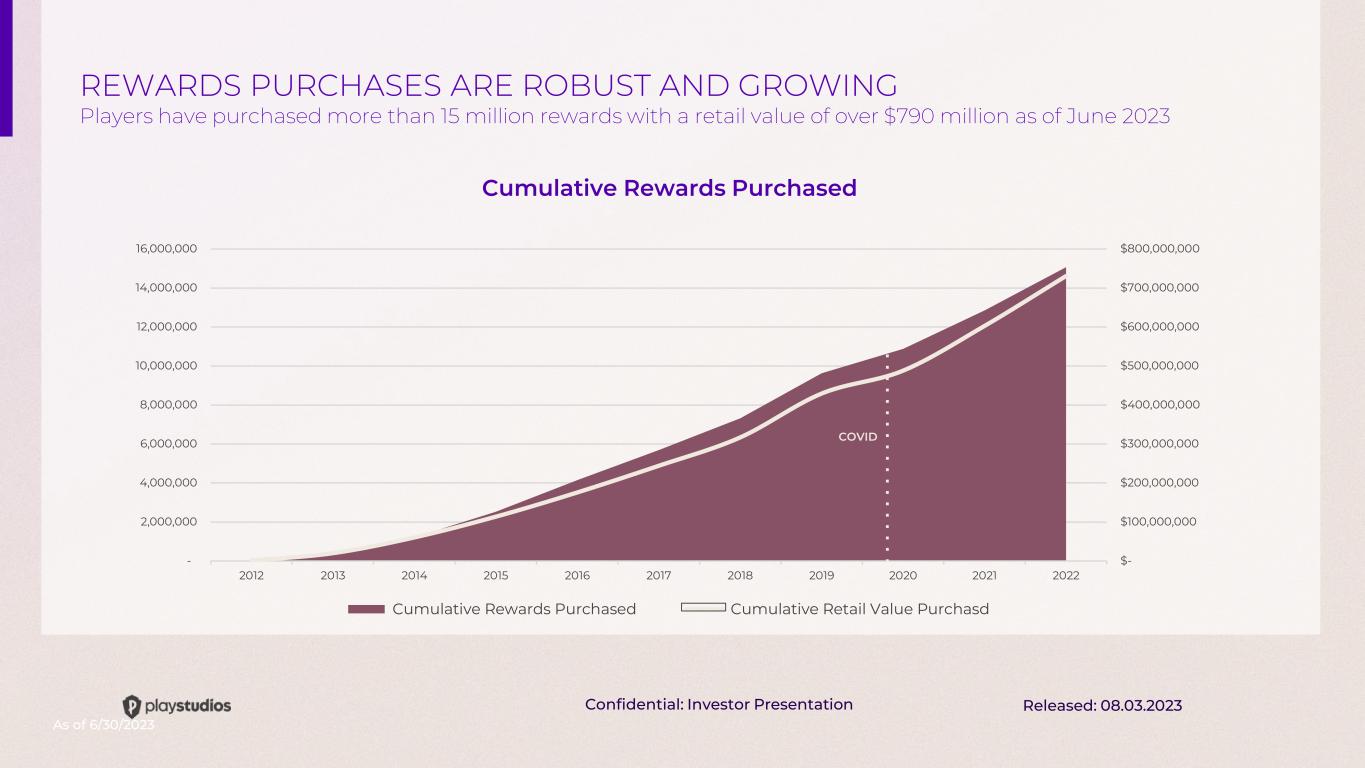

Confidential: Investor Presentation Released: 08.03.2023 Cumulative Rewards Purchased $- $100,000,000 $200,000,000 $300,000,000 $400,000,000 $500,000,000 $600,000,000 $700,000,000 $800,000,000 - 2,000,000 4,000,000 6,000,000 8,000,000 10,000,000 12,000,000 14,000,000 16,000,000 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Cumulative Rewards Purchased Cumulative Retail Value Purchasd COVID As of 6/30/2023 REWARDS PURCHASES ARE ROBUST AND GROWING Players have purchased more than 15 million rewards with a retail value of over $790 million as of June 2023

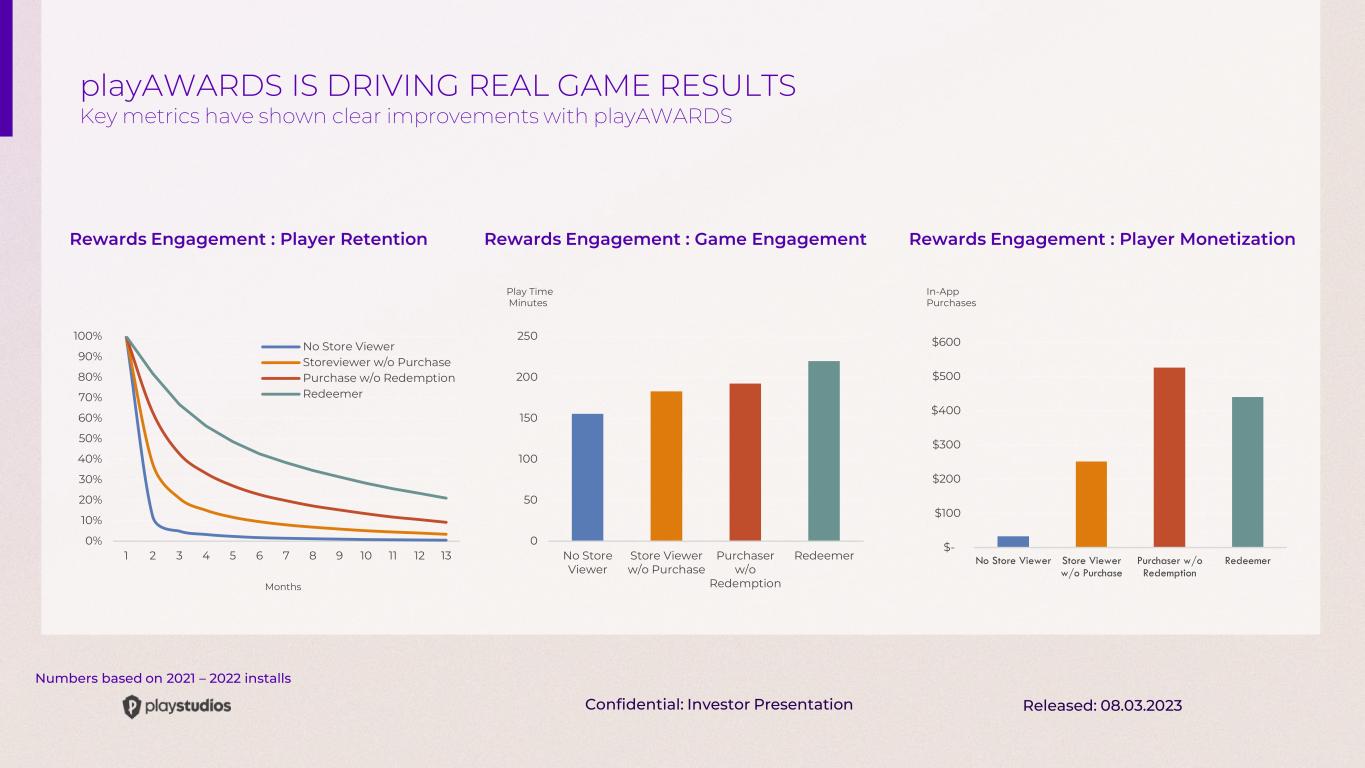

Confidential: Investor Presentation Released: 08.03.2023 Numbers based on 2021 – 2022 installs playAWARDS IS DRIVING REAL GAME RESULTS Key metrics have shown clear improvements with playAWARDS 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 1 2 3 4 5 6 7 8 9 10 11 12 13 No Store Viewer Storeviewer w/o Purchase Purchase w/o Redemption Redeemer 0 50 100 150 200 250 No Store Viewer Store Viewer w/o Purchase Purchaser w/o Redemption Redeemer Rewards Engagement : Player Retention Rewards Engagement : Game Engagement Play Time Minutes Rewards Engagement : Player Monetization In-App Purchases Months $- $100 $200 $300 $400 $500 $600 No Store Viewer Store Viewer w/o Purchase Purchaser w/o Redemption Redeemer

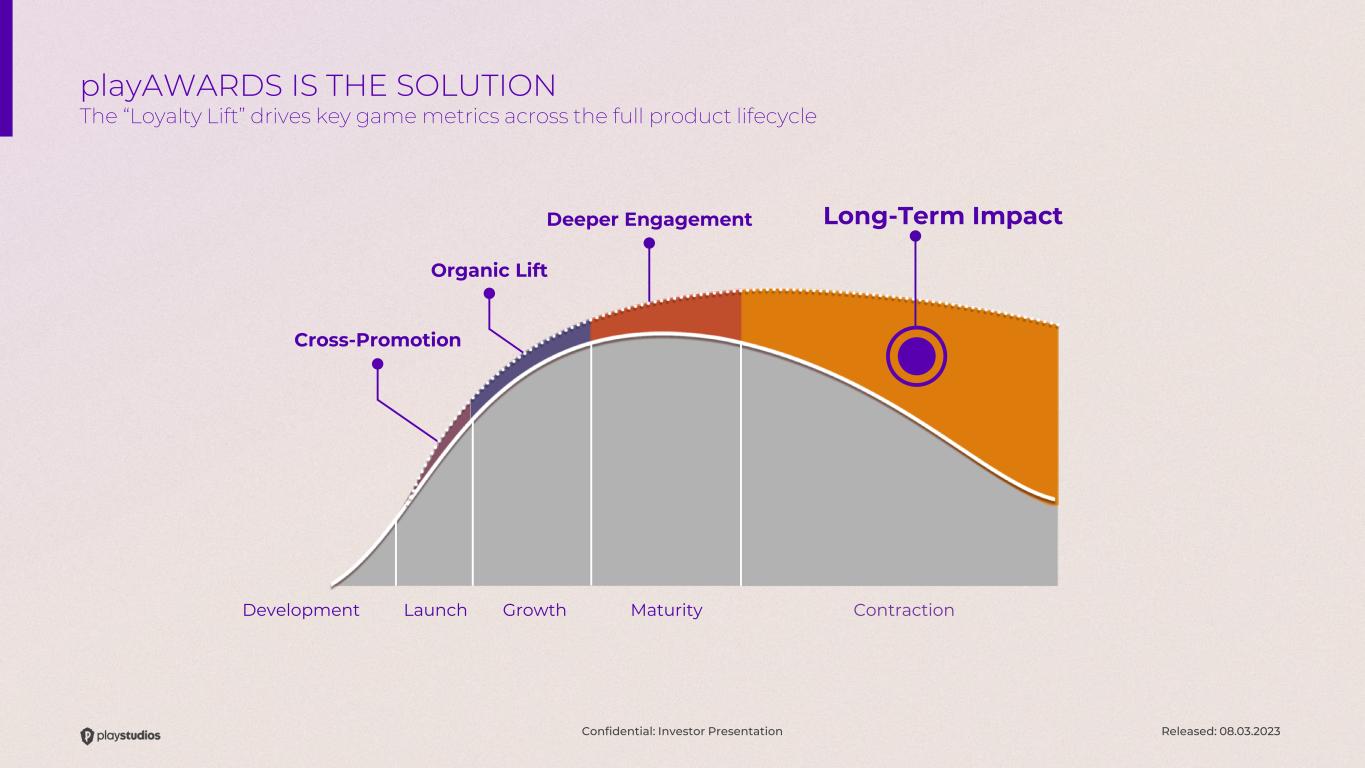

Confidential: Investor Presentation Released: 08.03.2023 Long-Term Impact Cross-Promotion Organic Lift Deeper Engagement Development Launch Growth Maturity Contraction playAWARDS IS THE SOLUTION The “Loyalty Lift” drives key game metrics across the full product lifecycle

Released: 08.03.2023 The Opportunity

Confidential: Investor Presentation Released: 08.03.2023 1. Advance the playAWARDS Platform Integrate into third-party, external games, and continue to extend platform functionality 2. Increase Profitability Expand AEBITDA margins, increase efficiency, and add new features + live ops density 3. Expand / Diversify Games Portfolio Scale audiences for Bingo and MGM Slots Live, optimize Tetris Mobile, diversification through organic growth, expand growth titles, pursue M&A opportunities 4. Enhance Our Business Model In-app advertising and e-commerce Strategic Growth Goals for 2023 Profitability, Expansion, Diversification

Confidential: Investor Presentation Released: 08.03.2023 Expand playAWARDS Presence playAWARDS DIVISION GOALS 2023 and beyond Incorporate the myVIP Program into all PLAYSTUDIOS apps, entering the casual and puzzle genres with Tetris and Brainium titles. Launch playAWARDS LaaS Roll out “Loyalty as a Service” to third-party apps, further scaling the platforms audience network. Enhance Functionality Introduce new reward categories and enable player-to-player reward transferability.

Confidential: Investor Presentation Released: 08.03.2023 playAWARDS AS A CROSS PLAY DRIVER IN OUR GAMES With a shared loyalty currency and a presence in our entire game library in 2023, playAWARDS is expected to drive cross play

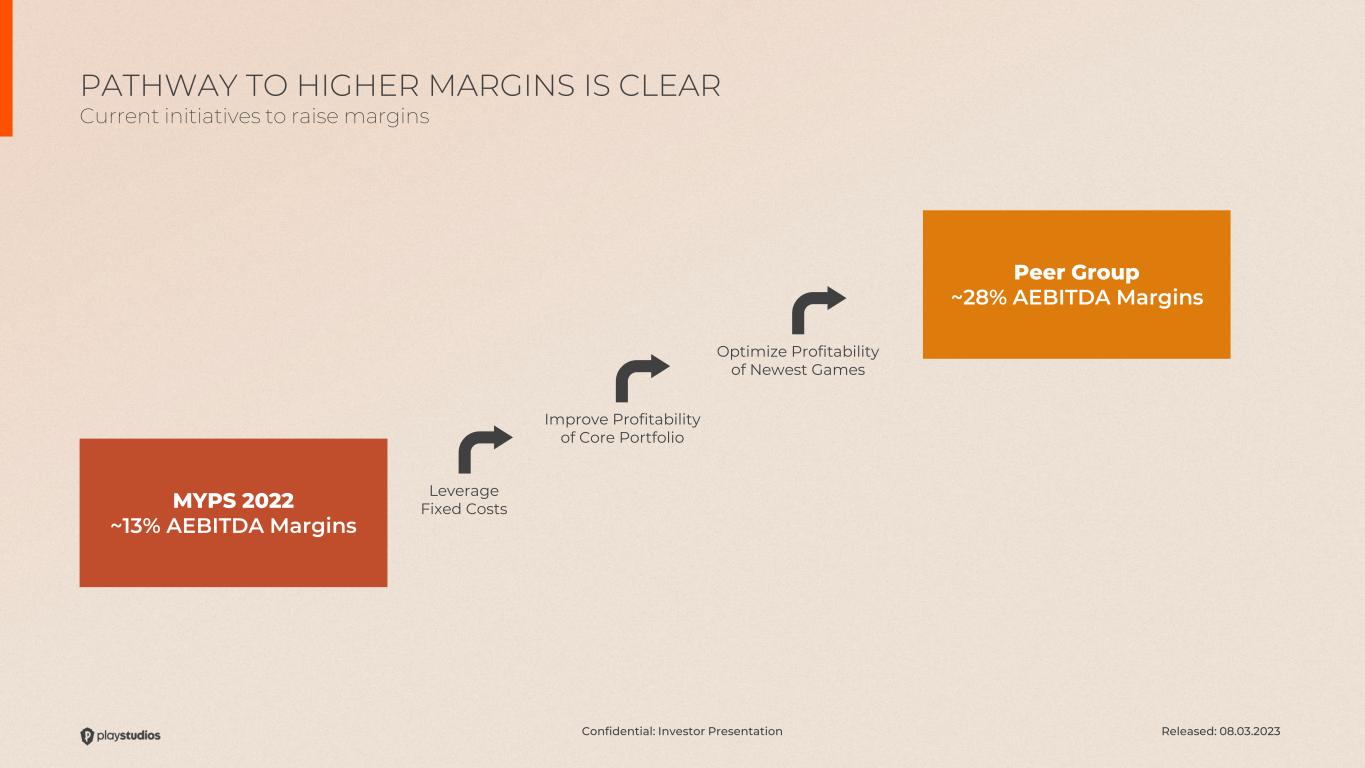

Confidential: Investor Presentation Released: 08.03.2023 MYPS 2022 ~13% AEBITDA Margins Peer Group ~28% AEBITDA Margins Leverage Fixed Costs Optimize Profitability of Newest Games Improve Profitability of Core Portfolio PATHWAY TO HIGHER MARGINS IS CLEAR Current initiatives to raise margins

Confidential: Investor Presentation Released: 08.03.2023 Advertising will now be a meaningful portion of total revenues AdMon is higher margin - no platform fees Diversified Revenue Stream - 2022 Scaling AdMon in social casino portfolio Tetris and Brainium are AdMon games FOCUS ON IMPROVING PROFITABILITY IN 2023 Gaming business is being fundamentally reset towards higher profit Revenue Mix Pre-Brainium IAP Advertising Other Revenue Mix Post-Brainium IAP Advertising Other

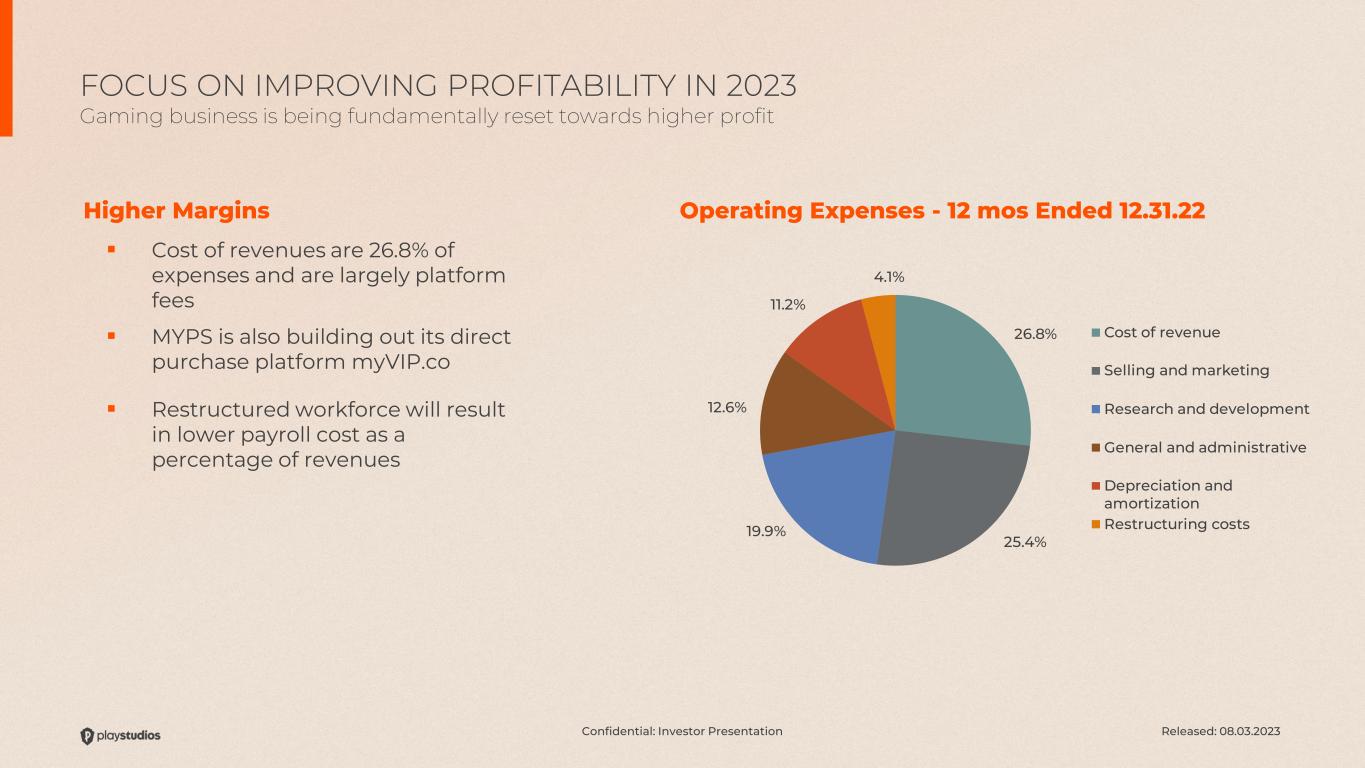

Confidential: Investor Presentation Released: 08.03.2023 Higher Margins ▪ Cost of revenues are 26.8% of expenses and are largely platform fees ▪ MYPS is also building out its direct purchase platform myVIP.co ▪ Restructured workforce will result in lower payroll cost as a percentage of revenues Operating Expenses - 12 mos Ended 12.31.22 FOCUS ON IMPROVING PROFITABILITY IN 2023 Gaming business is being fundamentally reset towards higher profit ost o reve ue Selli a ar eti Researc a evelo e t e eral a a i istrative e reciatio a a orti atio Restructuri costs

Confidential: Investor Presentation Released: 08.03.2023 Games will now be more evenly distributed between casual and social casino; the casual gaming market is 3x the size of social casino gaming. New Game Mix Targets Larger TAM in 2023 2023 Portfolio of Games (post-Brainium) 2022 Portfolio of Games (pre-Brainium) Social Casino Casual Games $7.5B Total Addressable Market, by Game Genre $23.5B 7 Games 1 Game 7 Games 11 Games Social Casino Casual Games FOCUS ON IMPROVING PROFITABILITY IN 2023 Gaming business is being fundamentally reset towards higher profit

Confidential: Investor Presentation Released: 08.03.2023 Casino $7.5 Billion Arcade & Action $17.5 Billion Adventure & Sim $17.8 Billion RPG & Strategy $25.2 Billion Brain & Puzzle $23.5 Billion *Source: Sensor Tower, Eilers & Krejcik Gaming EXPAND REACH ACROSS BROADER GAMING MARKET Diversifying into other, larger, gaming genres

Confidential: Investor Presentation Released: 08.03.2023 ▪ Broad catalog of casual games ▪ 2mm DAU, 5.5mm MAU ▪ 2022E Revenue of $22mm ▪ 2022E AEBITDA of $8.8mm ▪ 2022E AEBITDA margin of ~40% - High margin ad revenue ▪ Opportunity to drive synergies across product, UA, engagement and monetization BRAINIUM ACQUISITION Accretive acquisition that expands earnings, margins, DAU and diversifies company

Confidential: Investor Presentation Released: 08.03.2023 $30M share repurchase authorization ~$128M of cash Sources of Cash Opportunities $81M of unused facility Positive cash generation Strategic acquisitions in awards, gaming, or both Growth investments in current businesses STRONG CAPITAL POSITION Our strong capital position protects us from economic uncertainty and gives us tremendous spending flexibility

Released: 08.03.2023 Financials

Confidential: Investor Presentation Released: 08.03.2023 ▪ Strong balance sheet with cash holdings of ~$128 million and no borrowings on our revolver ▪ Cash generative business model ▪ Initiated a repurchase program in 4Q22 and have purchased $20.0mm of stock through August 3, 2023 ▫ Continue to view share repurchases as attractive use of capital ▪ Strong, double-digit growth over the past 10 years ▫ 2012-2022 Revenue CAGR +61% ▪ Growing all important gaming metrics ▫ 2012-2022 DAU CAGR ~50% ▫ 2012-2022 ARPDAU CAGR ~9% FINANCIALS: WELL CAPITALIZED AND GROWING FAST Blue chip balance sheet ensures stability and provides for future investments in growth

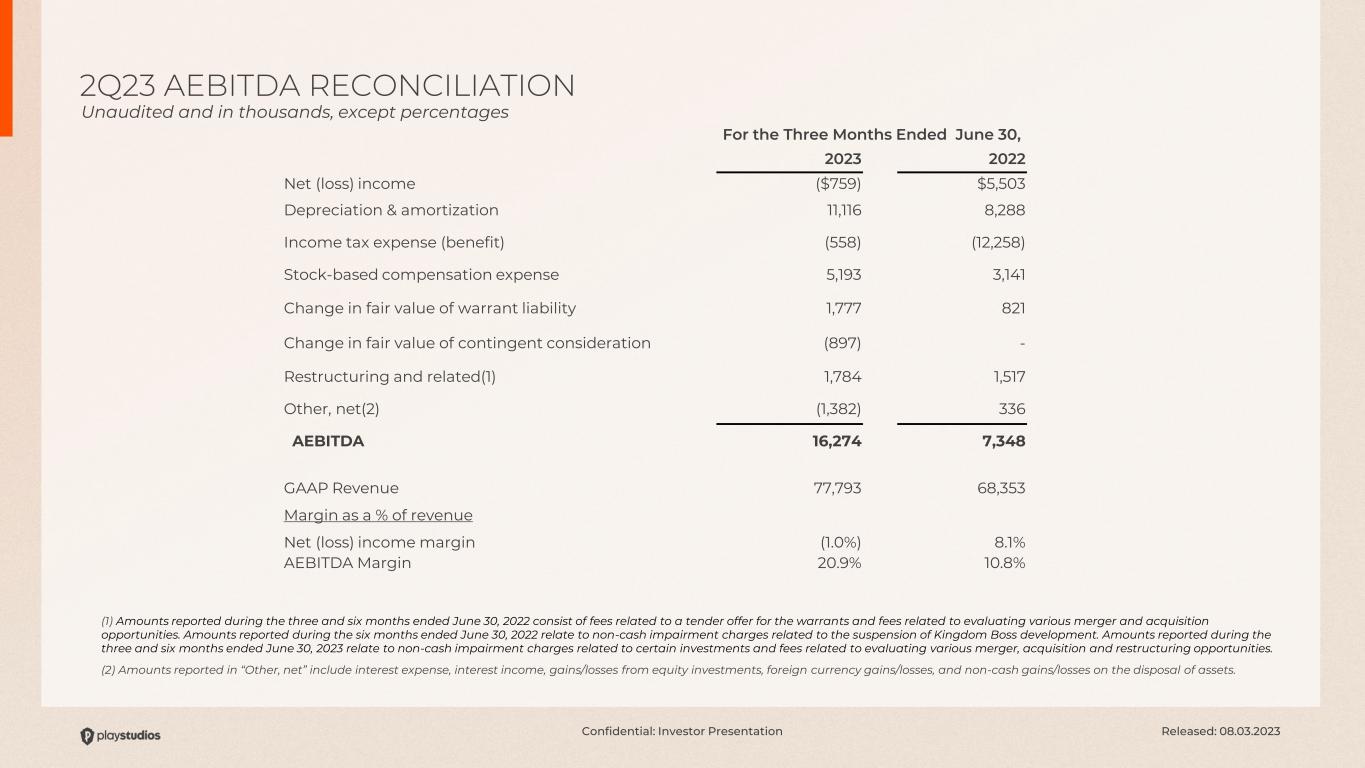

Confidential: Investor Presentation Released: 08.03.2023 2Q23 Financial Metrics ▪ Revenues: $77.8 million; 14% y/y growth ▪ Net loss (GAAP) of $0.8 million ▪ AEBITDA: $16.3 million; 122% y/y growth ▪ AEBITDA Margin: 20.9%; +1010bps increase vs. 2Q22 ▪ Cash Balance: $128 million ▪ No debt ▪ Continued stock buyback; repurchased $20.0mm of shares through August 3, 2023 Game Metrics ▪ Portfolio of 18 Games ▪ 3.7 million DAU ▪ 13.7 million MAU 2Q23 FINANCIAL RESULTS 2Q23 results were up substantially y/y and ahead of consensus expectations

Confidential: Investor Presentation Released: 08.03.2023 2023 Consolidated Company Guidance ▪ Revenues of $305 - $325 million ▪ AEBITDA of $55.0 - $60.0 million ▪ At midpoint, guidance implies 9% year/year growth in revenues and 50% year/year growth in AEBITDA ▪ Implied AEBITDA margin of 18.3% at midpoint; 510bps ahead of 2022 figure ▪ Results include a full year of Brainium ▪ Results exclude: synergies from the Brainium transaction, and further M&A 2023 FINANCIAL GUIDANCE Substantial growth projected in 2023

Confidential: Investor Presentation Released: 08.03.2023 01 02 Unique Vision and Model Games players love, real-world benefits they want. Diversified Portfolio Expanding model provides for future growth. 03 04 Margin Expansion Balancing future growth with near- term margin improvement. Aligned Interests Leadership and investor interests are aligned.

Confidential: Investor Presentation Released: 08.03.2023 (1) Amounts reported during the three and six months ended June 30, 2022 consist of fees related to a tender offer for the warrants and fees related to evaluating various merger and acquisition opportunities. Amounts reported during the six months ended June 30, 2022 relate to non-cash impairment charges related to the suspension of Kingdom Boss development. Amounts reported during the three and six months ended June 30, 2023 relate to non-cash impairment charges related to certain investments and fees related to evaluating various merger, acquisition and restructuring opportunities. (2) Amounts reported in “Other, net” include interest expense, interest income, gains/losses from equity investments, foreign currency gains/losses, and non-cash gains/losses on the disposal of assets. For the Three Months Ended June 30, 2023 2022 Net (loss) income ($759) $5,503 Depreciation & amortization 11,116 8,288 Income tax expense (benefit) (558) (12,258) Stock-based compensation expense 5,193 3,141 Change in fair value of warrant liability 1,777 821 Change in fair value of contingent consideration (897) - Restructuring and related(1) 1,784 1,517 Other, net(2) (1,382) 336 AEBITDA 16,274 7,348 GAAP Revenue 77,793 68,353 Margin as a % of revenue Net (loss) income margin (1.0%) 8.1% AEBITDA Margin 20.9% 10.8% 2Q23 AEBITDA RECONCILIATION Unaudited and in thousands, except percentages

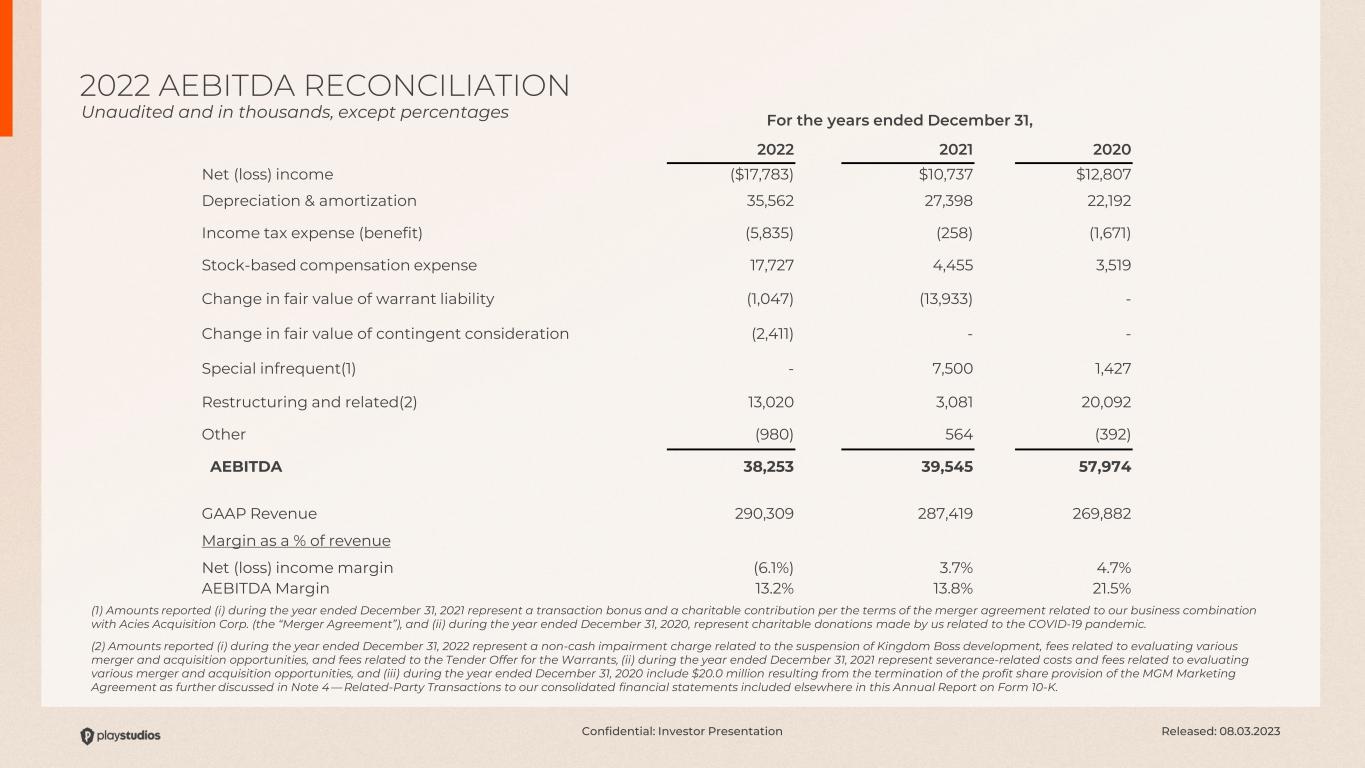

Confidential: Investor Presentation Released: 08.03.2023 For the years ended December 31, 2022 2021 2020 Net (loss) income ($17,783) $10,737 $12,807 Depreciation & amortization 35,562 27,398 22,192 Income tax expense (benefit) (5,835) (258) (1,671) Stock-based compensation expense 17,727 4,455 3,519 Change in fair value of warrant liability (1,047) (13,933) - Change in fair value of contingent consideration (2,411) - - Special infrequent(1) - 7,500 1,427 Restructuring and related(2) 13,020 3,081 20,092 Other (980) 564 (392) AEBITDA 38,253 39,545 57,974 GAAP Revenue 290,309 287,419 269,882 Margin as a % of revenue Net (loss) income margin (6.1%) 3.7% 4.7% AEBITDA Margin 13.2% 13.8% 21.5% (1) Amounts reported (i) during the year ended December 31, 2021 represent a transaction bonus and a charitable contribution per the terms of the merger agreement related to our business combination with Acies Acquisition Corp. (the “Merger Agreement”), and (ii) during the year ended December 31, 2020, represent charitable donations made by us related to the COVID-19 pandemic. (2) Amounts reported (i) during the year ended December 31, 2022 represent a non-cash impairment charge related to the suspension of Kingdom Boss development, fees related to evaluating various merger and acquisition opportunities, and fees related to the Tender Offer for the Warrants, (ii) during the year ended December 31, 2021 represent severance-related costs and fees related to evaluating various merger and acquisition opportunities, and (iii) during the year ended December 31, 2020 include $20.0 million resulting from the termination of the profit share provision of the MGM Marketing Agreement as further discussed in Note 4 — Related-Party Transactions to our consolidated financial statements included elsewhere in this Annual Report on Form 10-K. 2022 AEBITDA RECONCILIATION Unaudited and in thousands, except percentages