Investor Presentation

3 Disclaimer Forward-Looking Statements This presentation contains forward-looking statements that relate to anticipated future events, including anticipated future operating results, business performance, and financial conditions. The company’s actual results may differ from the company’s current expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events or results. In some cases, forward-looking statements will be identified by words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “guidance,” “outlook,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions. These forward-looking statements are subject to risks, uncertainties and other factors that could cause the actual results to differ materially from those expressed or implied by such forward-looking statements. Most of these risks, uncertainties and other factors are outside the company’s control and are difficult to predict. Factors that could impact the company’s future performance and cause actual results to differ from the forward-looking statements contained in this presentation include, but are not limited to, risks and uncertainties identified from time to time in the company’s filings with the U.S. Securities and Exchange Commission (the “SEC”). In addition, forward-looking statements contained in this presentation are based on assumptions that the company believes to be reasonable as of this date. The company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this presentation or to reflect new information or the occurrence of unanticipated events, except as required by law. Unaudited and Non-GAAP Financial Measures This presentation contains financial data that is not audited and financial data that was not prepared in accordance with accounting principles generally accepted in the United States (“GAAP). PLAYSTUDIOS uses certain non-GAAP financial measures, including Adjusted EBITDA or AEBITDA, to analyze underlying business performance and trends. The company believes the presentation of these non-GAAP financial measures provides useful information to investors and management in analyzing and benchmarking the financial and operating performance of the company’s business. Non-GAAP financial measures are not measures of financial performance determined in accordance with GAAP and should not be considered a substitute for, or superior to, financial measures determined or calculated in accordance with GAAP. The non-GAAP financial measures contained in this presentation are not meant to be considered in isolation or as a substitute for comparable GAAP measures and should be read in conjunction with PLAYSTUDIOS’ consolidated financial statements prepared in accordance with GAAP. In addition, non-GAAP measures contained in this presentation reflect the exercise of management’s judgment regarding which items are included or excluded in their determination, and as a result the company’s definitions of non-GAAP financial measures may not be comparable to similarly titled measures reported by other companies. Please refer to our SEC filings for reconciliation of the non-GAAP financial measures contained herein to the most directly comparable measures in accordance with GAAP. Key Performance Indicators We manage our business by regularly reviewing several key operating metrics to track historical performance, identify trends in player activity, and set strategic goals for the future. Our key performance metrics are impacted by several factors that could cause them to fluctuate on a quarterly basis, such as platform providers’ policies, seasonality, player connectivity, and the addition of new content to games. The key performance indicators may differ from similarly titled measures presented by other companies. For more information on our key performance indicators, please refer to the definitions and additional information contained in our SEC filings. Industry Data This presentation refers to, and in some cases relies upon, certain information, statistics and forecasts obtained from third-party sources. While the company believes such third-party sources to be reliable, the company has not independently verified the accuracy completeness of any such third-party data. This presentation contains trademarks, service marks, trade names and copyrights of PLAYSTUDIOS and other companies, which are the property of their respective owners.

Samir Jain Treasury & Investor Relations PLAYSTUDIOS samir.jain@playstudios.com 4

5 Key Investment Highlights PLAYSTUDIOS at-a-glance Rapidly Diversifying Game Portfolio Brainium and Tetris are diversifying revenue streams to faster growing and higher margin casual gaming segment. playAWARDS Platform a Key Differentiator Proprietary loyalty program creates value for players, publishers, and global brand partners. Preparing to externalize platform in 2024 to third party developers and strategic business partners. Strong Leadership with Aligned Interests Numerous executives and board members are among the largest shareholders. CEO is 3rd largest shareholder. Sustained Growth and Strong Capital Position Double-digit, 10-year CAGR. Cash generative business with ~$133MM on hand, as of 12/31/2023. $50MM share repurchase authorization availability. $81MM available revolving credit line. Building a Tetris Franchise Looking to develop and release 1-2 new Tetris games this year and continue adding to library thereafter. Believe Tetris can be a core gaming franchise for MYPS.

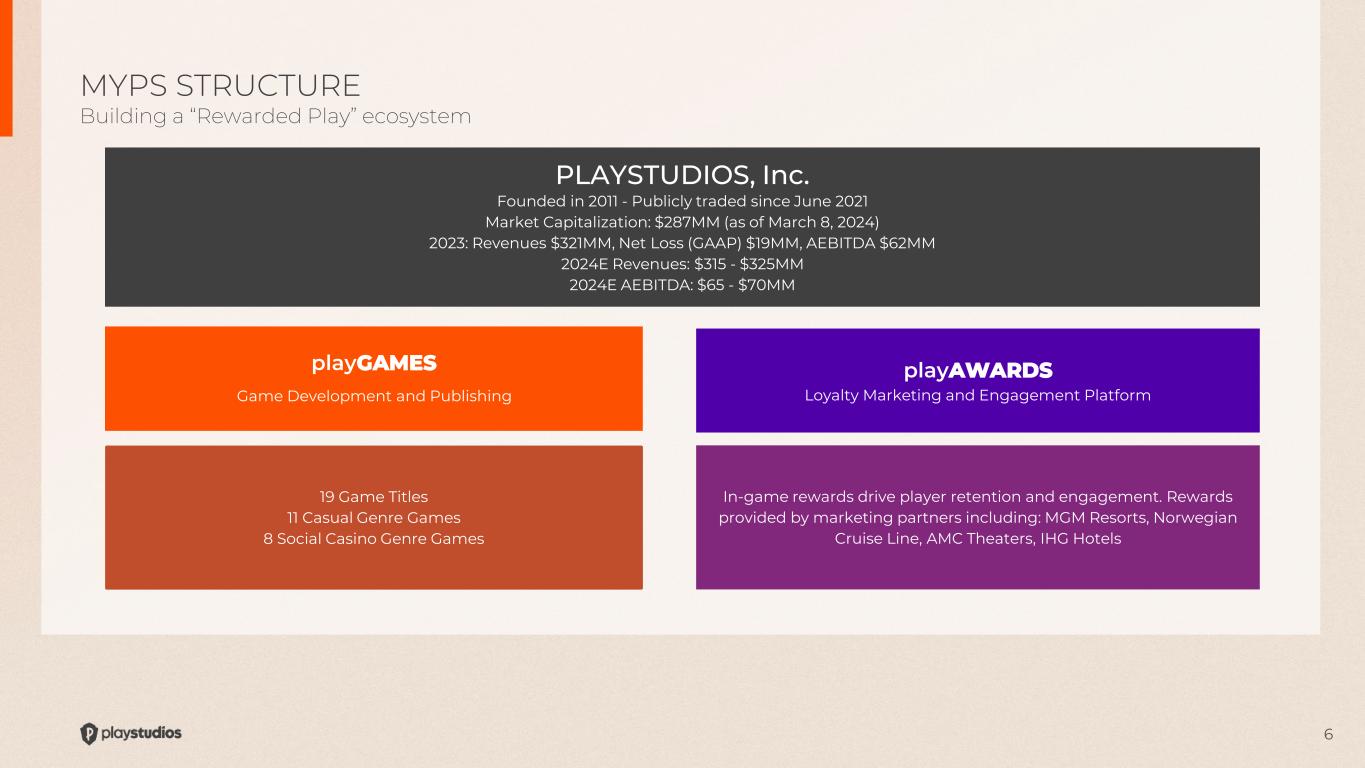

6 MYPS STRUCTURE Building a “Rewarded Play” ecosystem playAWARDS Loyalty Marketing and Engagement Platform In-game rewards drive player retention and engagement. Rewards provided by marketing partners including: MGM Resorts, Norwegian Cruise Line, AMC Theaters, IHG Hotels 19 Game Titles 11 Casual Genre Games 8 Social Casino Genre Games playGAMES Game Development and Publishing PLAYSTUDIOS, Inc. Founded in 2011 - Publicly traded since June 2021 Market Capitalization: $287MM (as of March 8, 2024) 2023: Revenues $321MM, Net Loss (GAAP) $19MM, AEBITDA $62MM 2024E Revenues: $315 - $325MM 2024E AEBITDA: $65 - $70MM

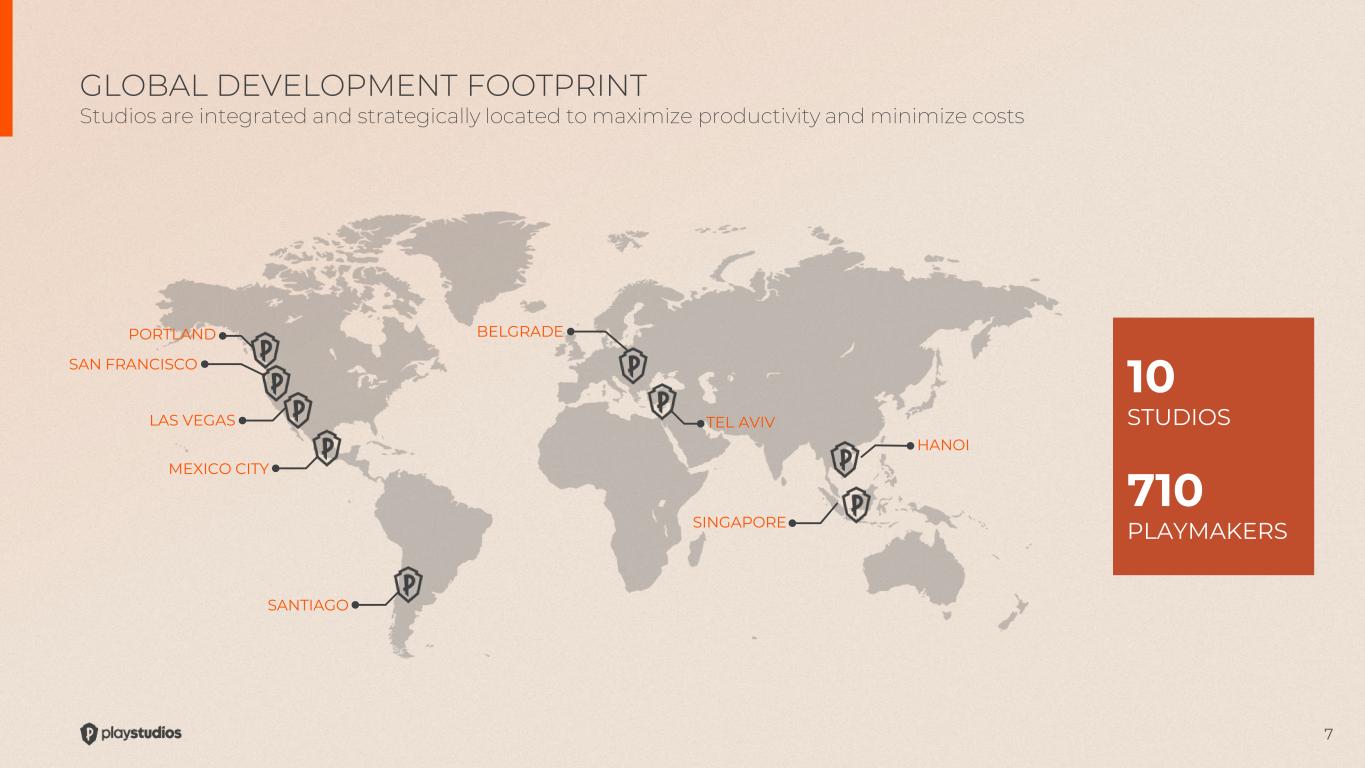

7 SAN FRANCISCO LAS VEGAS BELGRADE TEL AVIV SINGAPORE HANOI 10 STUDIOS 710 PLAYMAKERS PORTLAND MEXICO CITY SANTIAGO GLOBAL DEVELOPMENT FOOTPRINT Studios are integrated and strategically located to maximize productivity and minimize costs

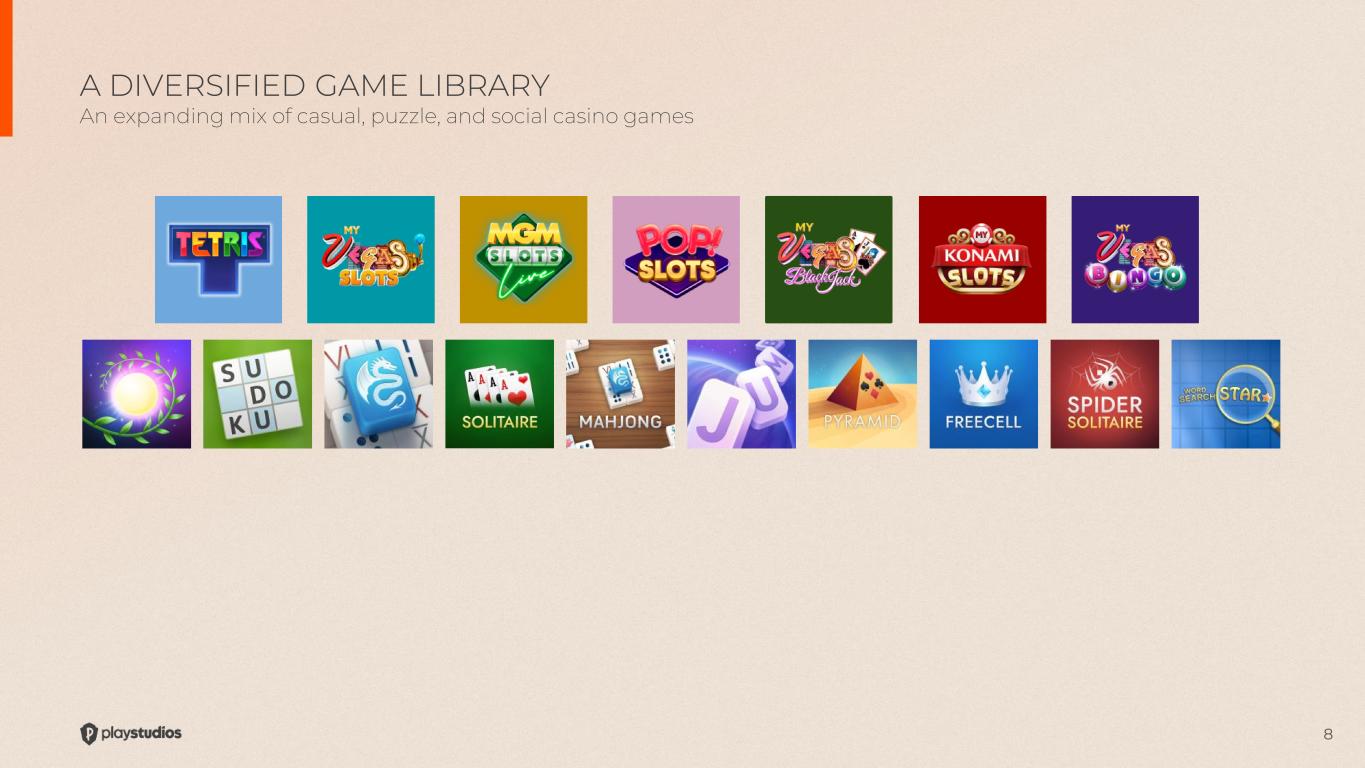

8 A DIVERSIFIED GAME LIBRARY An expanding mix of casual, puzzle, and social casino games

9 13.3 Million MAU 54% Female 46% Male 3.4 Million DAU $80K Average Income 2.4 Sessions / Day 37 Minutes / Day 2.5 Million Reward Purchasers 16.6 Million Rewards Purchased *As of 12/31/2023 LEADING GLOBAL GAME DEVELOPER AND PUBLISHER We have a large, captive, and loyal audience of players

11 AUDIENCE ACQUISITION BECOMING MORE DIFFICULT The ability to launch and scale games is more challenging than ever Rising Costs Large audience networks and sophisticated AdTech platforms are commanding higher prices in response to demand for top performing ad inventory. Targeting Less Effective GDPR, Deprecation of IDFA, and implementation of GAID now limit advertisers’ ability to efficiently target specific customer cohorts at scale. More Competition Growing competition for user attention across all forms of entertainment-games, social, streaming - makes it more difficult to hold an audience’s engagement.

12 Retention of existing customers is now more important than ever.

13 Community Building Content Releases and LiveOps Player Communications Compelling FTUEsPaid UA THE OLD PARADIGM Developers have relied on a fixed set of approaches to drive growth.

14 THE NEW PARADIGM Developers can leverage loyalty mechanics and real rewards to add a new dimension to their growth strategies. Player Communications Community Building Compelling FTUEs Paid UA Loyalty = Retention Content Releases and LiveOps

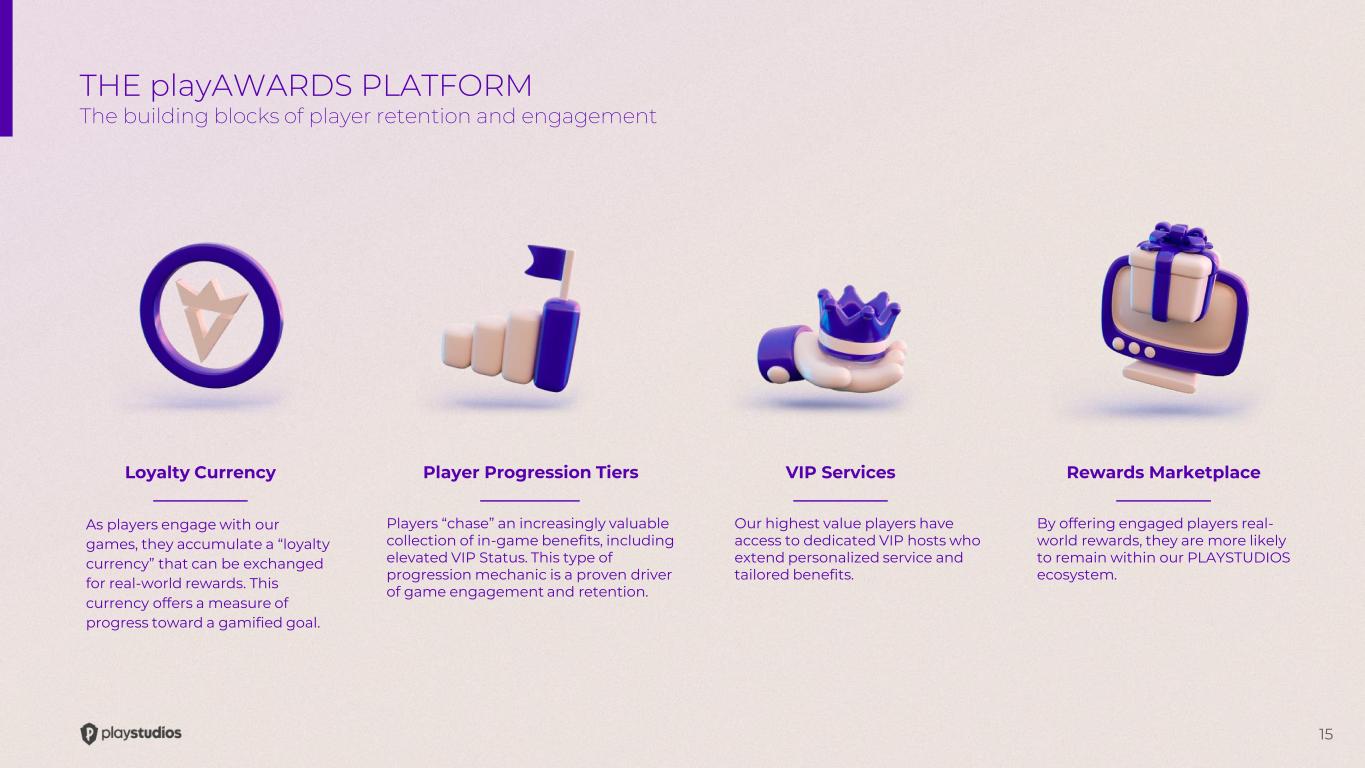

15 Player Progression Tiers Players “chase” an increasingly valuable collection of in-game benefits, including elevated VIP Status. This type of progression mechanic is a proven driver of game engagement and retention. Rewards Marketplace By offering engaged players real- world rewards, they are more likely to remain within our PLAYSTUDIOS ecosystem. Loyalty Currency As players engage with our games, they accumulate a “loyalty currency” that can be exchanged for real-world rewards. This currency offers a measure of progress toward a gamified goal. VIP Services Our highest value players have access to dedicated VIP hosts who extend personalized service and tailored benefits. THE playAWARDS PLATFORM The building blocks of player retention and engagement

16 Progression TiersRewards Marketplace Loyalty Currency Professional Services THE MYVIP PLATFORM FEATURES A collection of curated, real-world rewards presented in a dynamic digital storefront format. The Marketplace Module includes store configuration, inventory management, reward featuring, and fulfillment functionality. A dedicated loyalty currency marks players’ progress toward earning valuable rewards and leveling up their in-app loyalty status. The Currency Module includes a rich set of economy configuration tools that enable developers to optimize the impact of their loyalty program. Each app partner is assigned a dedicated playAWARDS team that helps design, implement, and optimize the implementation of the loyalty program based on player engagement analytics and insights. As players engage in app, they earn elevated loyalty program status which comes with richer benefits. The Progression Module includes a UX/UI framework, APIs, and back-end consoles for management and implementation.

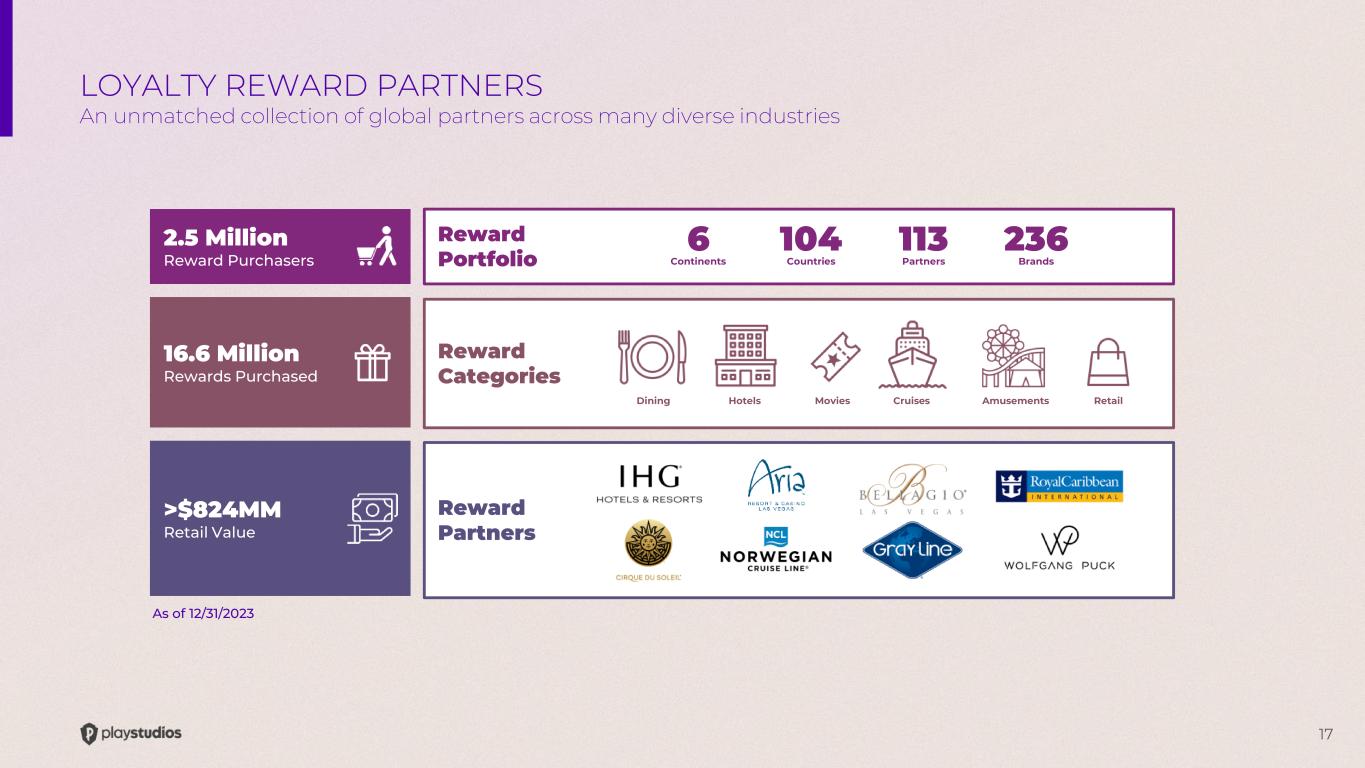

17 Reward Partners 2.5 Million Reward Purchasers >$824MM Retail Value Reward Portfolio Reward Categories 16.6 Million Rewards Purchased 6 Continents 104 Countries 113 Partners 236 Brands Dining Hotels Movies Cruises Amusements Retail As of 12/31/2023 LOYALTY REWARD PARTNERS An unmatched collection of global partners across many diverse industries

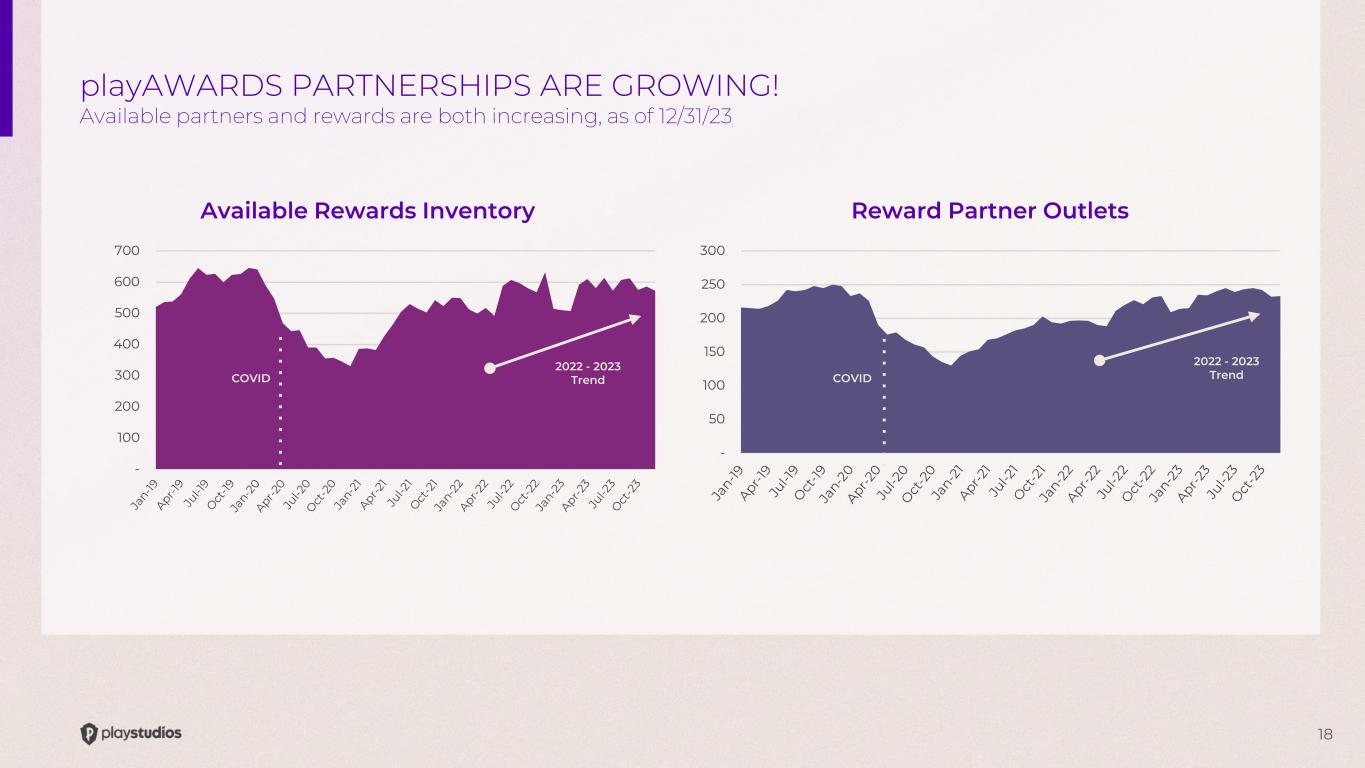

18 - 100 200 300 400 500 600 700 - 50 100 150 200 250 300 Available Rewards Inventory Reward Partner Outlets COVID COVID 2022 - 2023 Trend 2022 - 2023 Trend playAWARDS PARTNERSHIPS ARE GROWING! Available partners and rewards are both increasing, as of 12/31/23

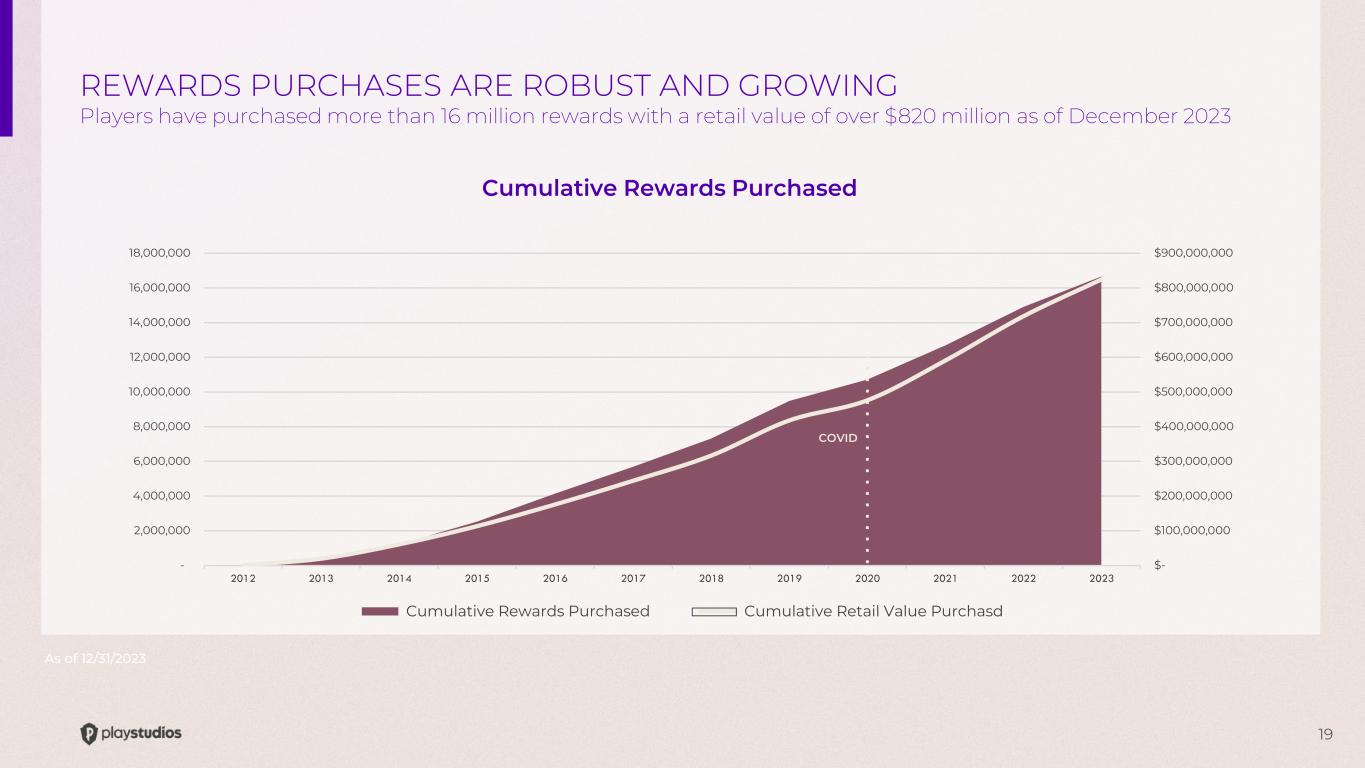

19 $- $100,000,000 $200,000,000 $300,000,000 $400,000,000 $500,000,000 $600,000,000 $700,000,000 $800,000,000 $900,000,000 - 2,000,000 4,000,000 6,000,000 8,000,000 10,000,000 12,000,000 14,000,000 16,000,000 18,000,000 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Cumulative Rewards Purchased Cumulative Retail Value Purchasd Cumulative Rewards Purchased COVID As of 12/31/2023 REWARDS PURCHASES ARE ROBUST AND GROWING Players have purchased more than 16 million rewards with a retail value of over $820 million as of December 2023

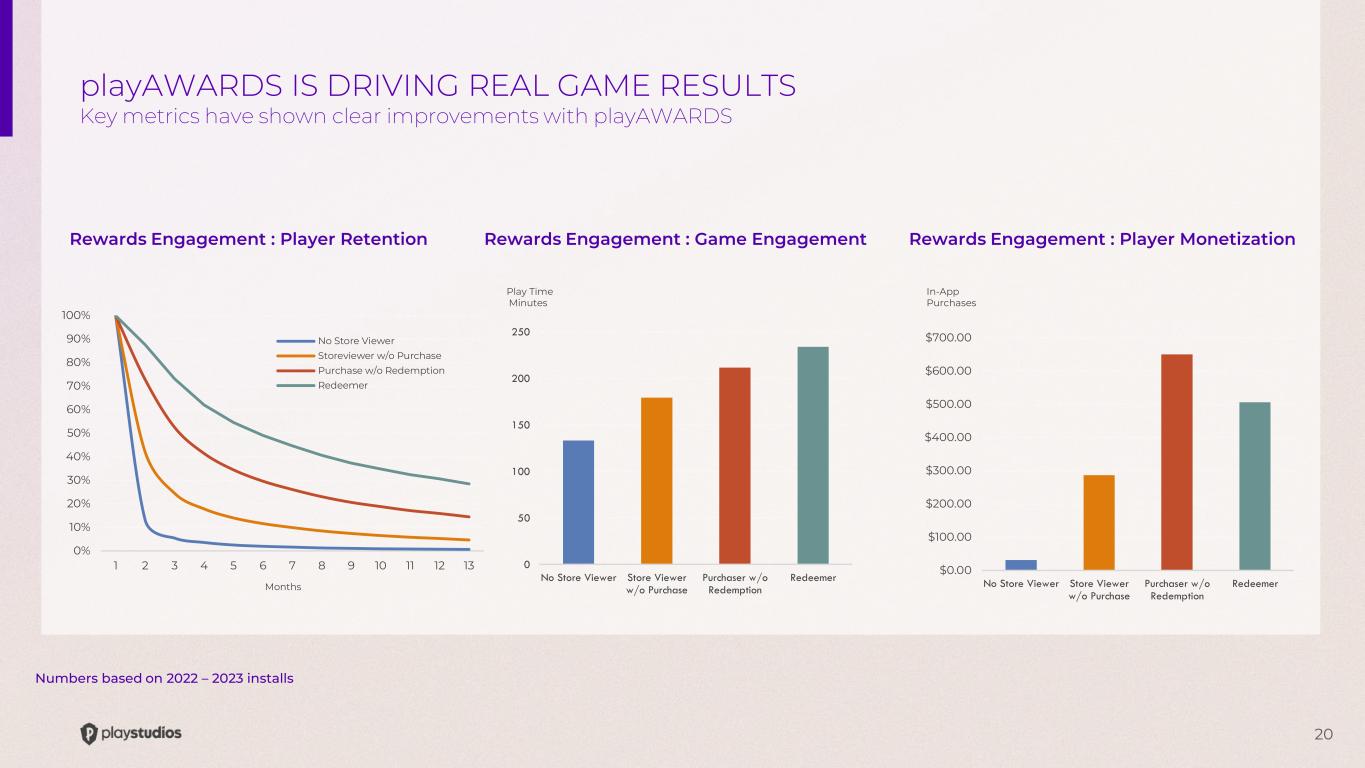

20 Numbers based on 2022 – 2023 installs playAWARDS IS DRIVING REAL GAME RESULTS Key metrics have shown clear improvements with playAWARDS Rewards Engagement : Player Retention Rewards Engagement : Game Engagement Play Time Minutes Rewards Engagement : Player Monetization In-App Purchases Months 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 1 2 3 4 5 6 7 8 9 10 11 12 13 No Store Viewer Storeviewer w/o Purchase Purchase w/o Redemption Redeemer $0.00 $100.00 $200.00 $300.00 $400.00 $500.00 $600.00 $700.00 No Store Viewer Store Viewer w/o Purchase Purchaser w/o Redemption Redeemer 0 50 100 150 200 250 No Store Viewer Store Viewer w/o Purchase Purchaser w/o Redemption Redeemer

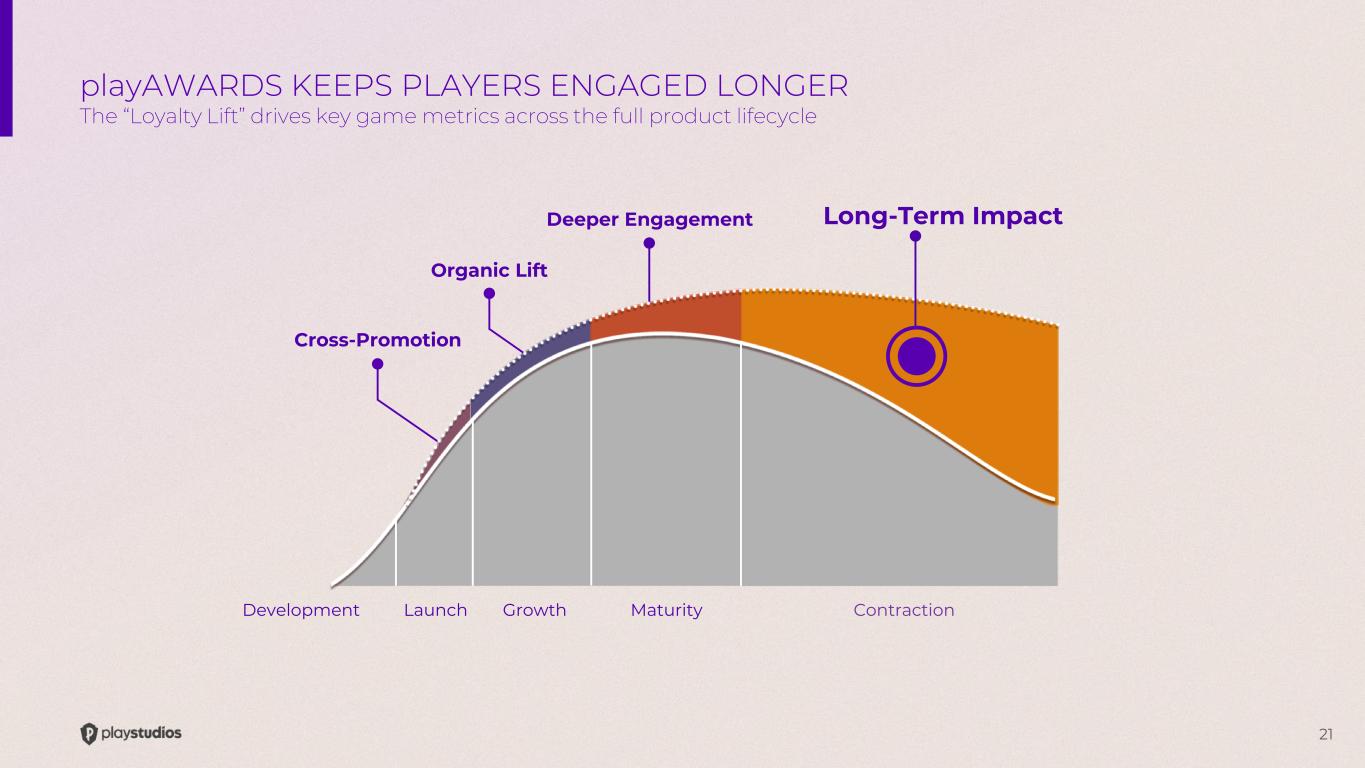

21 Long-Term Impact Cross-Promotion Organic Lift Deeper Engagement Development Launch Growth Maturity Contraction playAWARDS KEEPS PLAYERS ENGAGED LONGER The “Loyalty Lift” drives key game metrics across the full product lifecycle

The Opportunity

23 1. Advance playAWARDS / myVIP Integrate into third-party games, form new strategic partnerships, and continue to extend platform functionality 2. Increase Profitability Expanded AEBITDA from operating leverage, new games, greater efficiency, and new features + live ops density 3. Expand / Diversify Games Portfolio Scale audiences for growth games, optimize and grow Tetris brand, diversification through organic growth, expand growth titles, pursue M&A opportunities 4. Return Core Portfolio to Growth Stronger results in myVEGAS and myKONAMI from recent initiatives, stabilization in POP! Slots, and growth in Brainium and MGM Slots Live Strategic Goals for 2024 Growth, Profitability, Expansion, Diversification

24 Expand playAWARDS Presence playAWARDS DIVISION GOALS 2024 and beyond Incorporate the myVIP Program into all PLAYSTUDIOS apps, entering the casual and puzzle genres with Tetris and Brainium titles. Launch playAWARDS LaaS Roll out “Loyalty as a Service” to third-party apps, further scaling the platform’s audience network. Enhance Functionality Expand size and breadth of relationship with reward partners and third-party users.

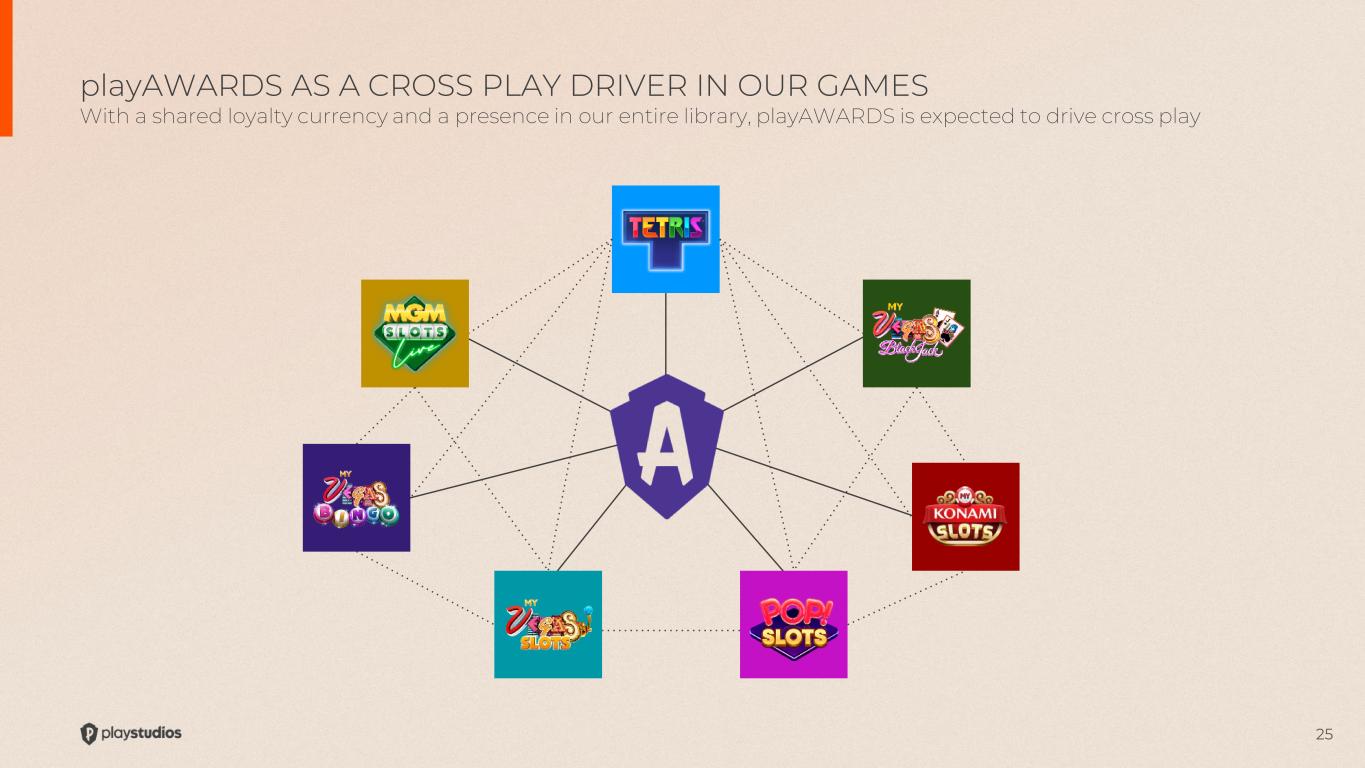

25 playAWARDS AS A CROSS PLAY DRIVER IN OUR GAMES With a shared loyalty currency and a presence in our entire library, playAWARDS is expected to drive cross play

26 MYPS 2023 ~20% AEBITDA Margins Peer Group ~28% AEBITDA Margins Leverage Fixed Costs Optimize Profitability of Newest Games Improve Profitability of Core Portfolio STRONG MARGINS GAINS IN 2023 CAN CONTINUE Our current initiatives support continued margin growth MYPS 2022 ~13% AEBITDA Margins +700bps GOAL MARGIN OPTIMIZATION FOCUS

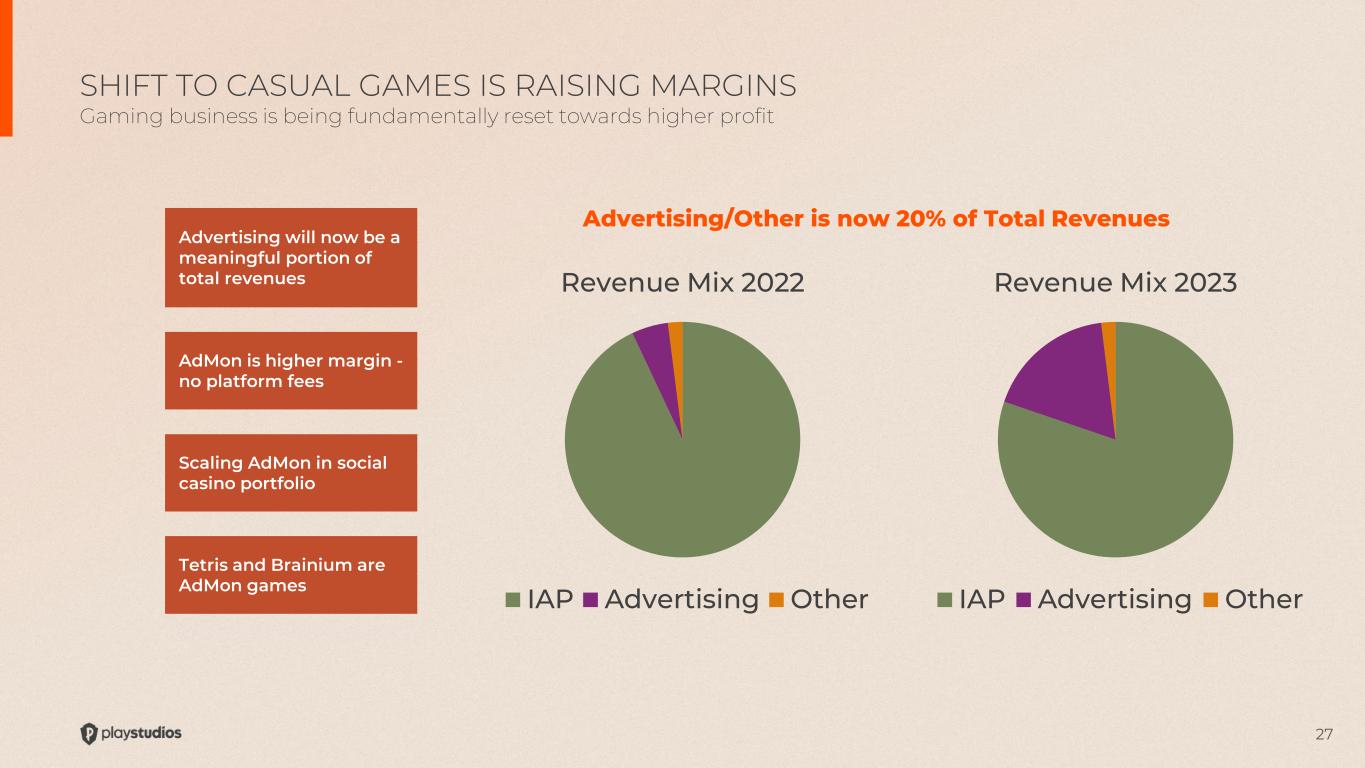

27 Advertising will now be a meaningful portion of total revenues AdMon is higher margin - no platform fees Advertising/Other is now 20% of Total Revenues Scaling AdMon in social casino portfolio Tetris and Brainium are AdMon games SHIFT TO CASUAL GAMES IS RAISING MARGINS Gaming business is being fundamentally reset towards higher profit Revenue Mix 2022 IAP Advertising Other Revenue Mix 2023 IAP Advertising Other

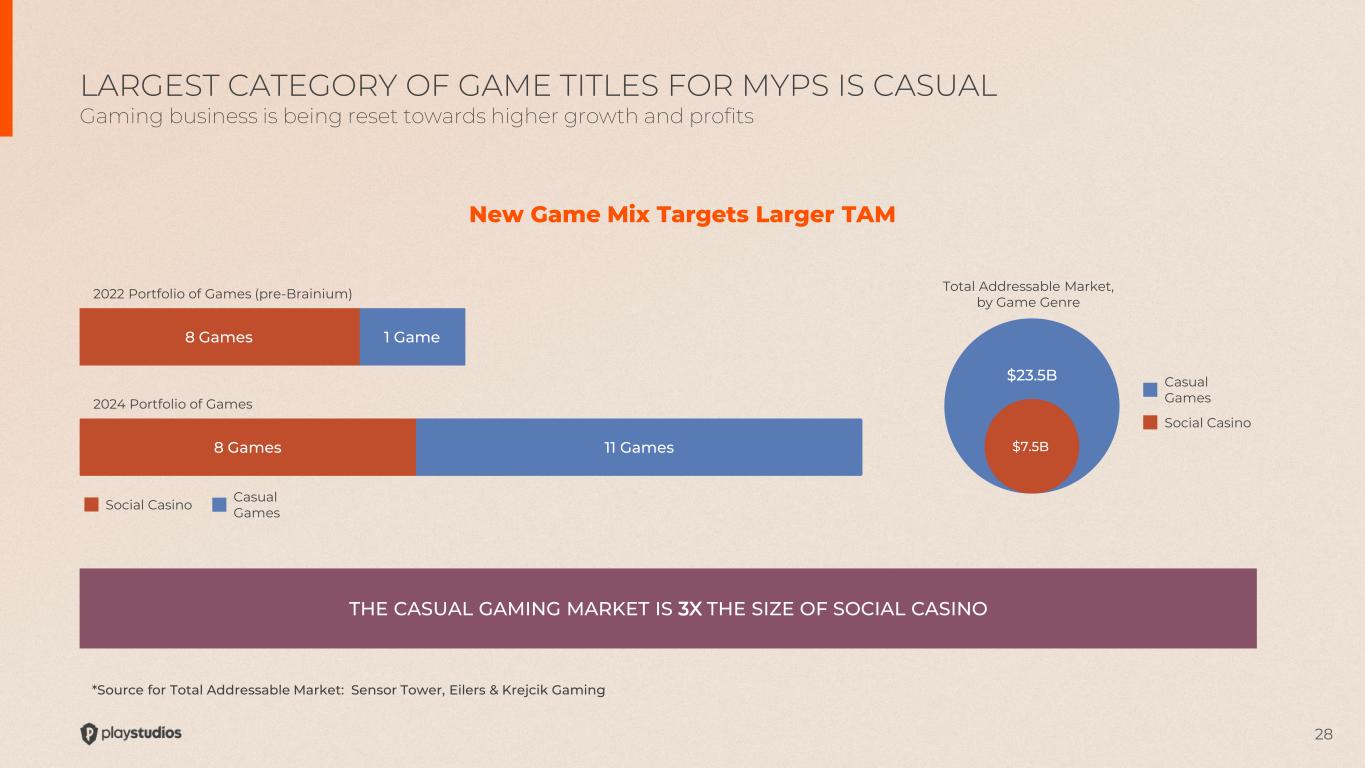

28 THE CASUAL GAMING MARKET IS 3X THE SIZE OF SOCIAL CASINO New Game Mix Targets Larger TAM 2024 Portfolio of Games 2022 Portfolio of Games (pre-Brainium) Social Casino Casual Games $7.5B Total Addressable Market, by Game Genre $23.5B 8 Games 1 Game 8 Games 11 Games Social Casino Casual Games LARGEST CATEGORY OF GAME TITLES FOR MYPS IS CASUAL Gaming business is being reset towards higher growth and profits *Source for Total Addressable Market: Sensor Tower, Eilers & Krejcik Gaming

29 Casino $7.5 Billion Arcade & Action $17.5 Billion Adventure & Sim $17.8 Billion RPG & Strategy $25.2 Billion Brain & Puzzle $23.5 Billion *Source: Sensor Tower, Eilers & Krejcik Gaming EXPAND REACH ACROSS BROADER GAMING MARKET Diversifying into other, larger, gaming genres

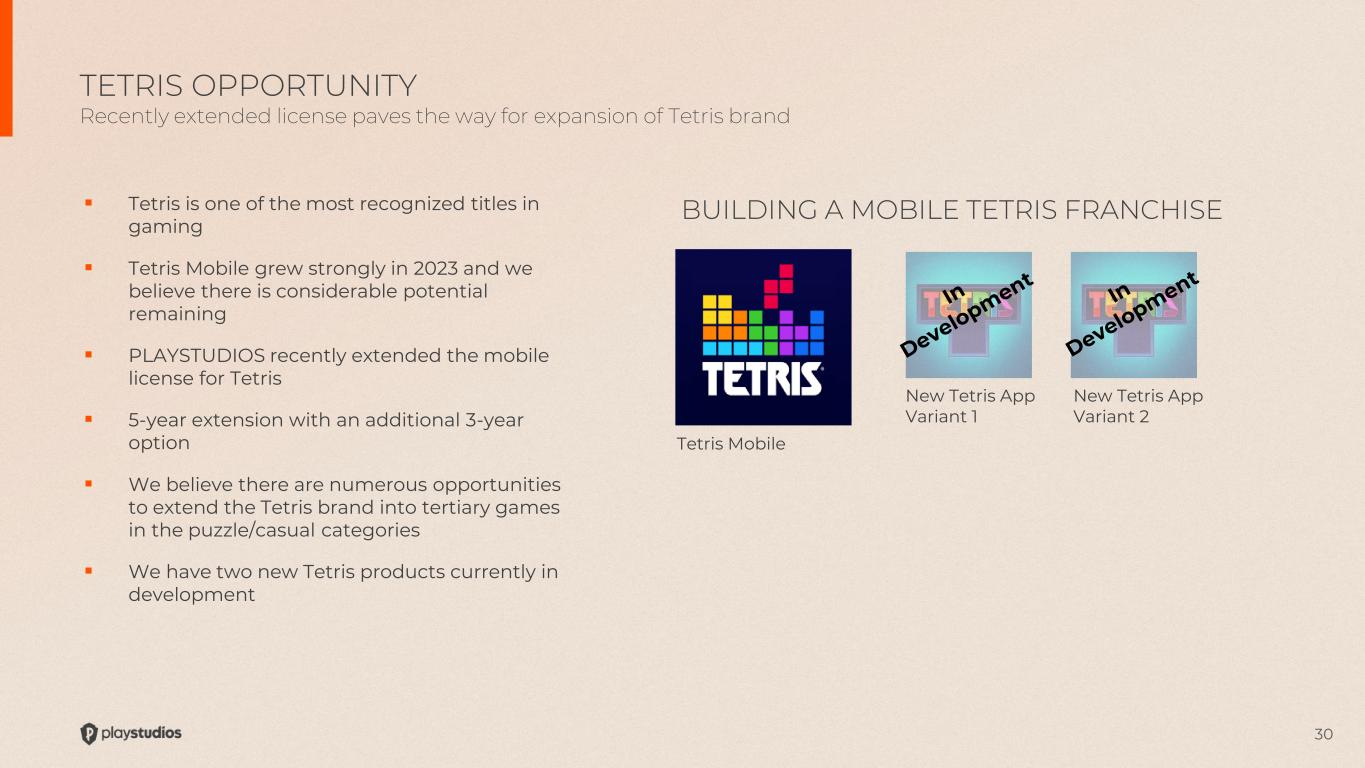

30 ▪ Tetris is one of the most recognized titles in gaming ▪ Tetris Mobile grew strongly in 2023 and we believe there is considerable potential remaining ▪ PLAYSTUDIOS recently extended the mobile license for Tetris ▪ 5-year extension with an additional 3-year option ▪ We believe there are numerous opportunities to extend the Tetris brand into tertiary games in the puzzle/casual categories ▪ We have two new Tetris products currently in development TETRIS OPPORTUNITY Recently extended license paves the way for expansion of Tetris brand Tetris Mobile New Tetris App Variant 1 New Tetris App Variant 2 BUILDING A MOBILE TETRIS FRANCHISE

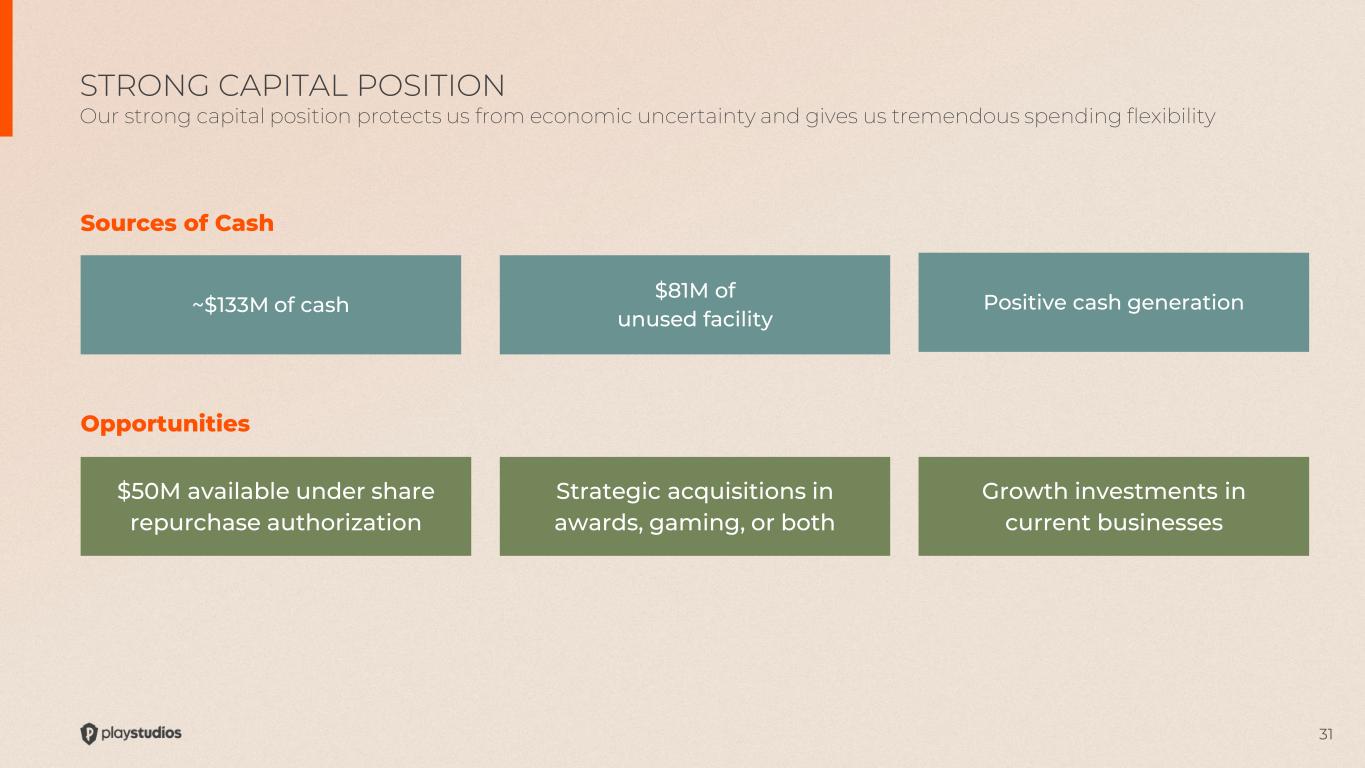

31 $50M available under share repurchase authorization ~$133M of cash Sources of Cash Opportunities $81M of unused facility Positive cash generation Strategic acquisitions in awards, gaming, or both Growth investments in current businesses STRONG CAPITAL POSITION Our strong capital position protects us from economic uncertainty and gives us tremendous spending flexibility

Financials

33 ▪ Strong balance sheet with cash holdings of ~$133 million and no borrowings on our revolver ▪ Cash generative business model ▪ Initiated a repurchase program in 4Q22 and have purchased $20.0mm of stock through March 11, 2024 ▪ Strong, double-digit growth over the past 10 years ▫ 2013-2023 Revenue CAGR +30% ▫ 2013-2023 AEBITDA CAGR +50% ▪ Growing all important gaming metrics ▫ 2013-2023 DAU CAGR ~30% ▫ 2013-2023 ARPDAU CAGR ~13%* FINANCIALS: WELL CAPITALIZED AND GROWING Blue chip balance sheet ensures stability and provides for future investments in growth *2023 ARPDAU based on social casino and excludes Tetris and Brainium. Tetris and Brainium derive revenues from advertising which dilutes the combined ARPDAU figures. Historical ARPDAU figures were based on Social Casino games making the comparison more accurate.

34 4Q23 Financial Metrics ▪ Revenues: $77.1 million ▪ Net loss (GAAP) of $19.9 million ▪ AEBITDA: $14.7 million; 22% y/y growth ▪ AEBITDA Margin: 19.1%; 390bps increase vs. 4Q22 ▪ Cash Balance: $133 million ▪ No debt Game Metrics ▪ Portfolio of 19 Games ▪ 3.4 million DAU ▪ 13.3 million MAU 4Q23 FINANCIAL RESULTS 4Q23 Revenues and AEBITDA were ahead of consensus expectations

35 2024 Consolidated Company Guidance ▪ Revenues of $315 - $325 million ▪ AEBITDA of $65 - $70 million ▪ At midpoint, guidance implies 3% year/year growth in revenues and 9% year/year growth in AEBITDA ▪ Implied AEBITDA margin of 21.1% at midpoint; +110bps ahead of 2023 figure ▪ Increase in playAWARDS’ revenues ▪ Developing 2 new Tetris titles with the plan to release at least one into the market in 2024 2024 FINANCIAL GUIDANCE Revenue and AEBITDA growth projected in 2024

36 01 02 Unique Vision and Model Games players love, real-world benefits they want. Diversified Portfolio Expanding model provides for future growth. 03 04 Strong Capital Position Large cash holdings, no leverage, postive cash generation. Aligned Interests Leadership and investor interests are aligned.

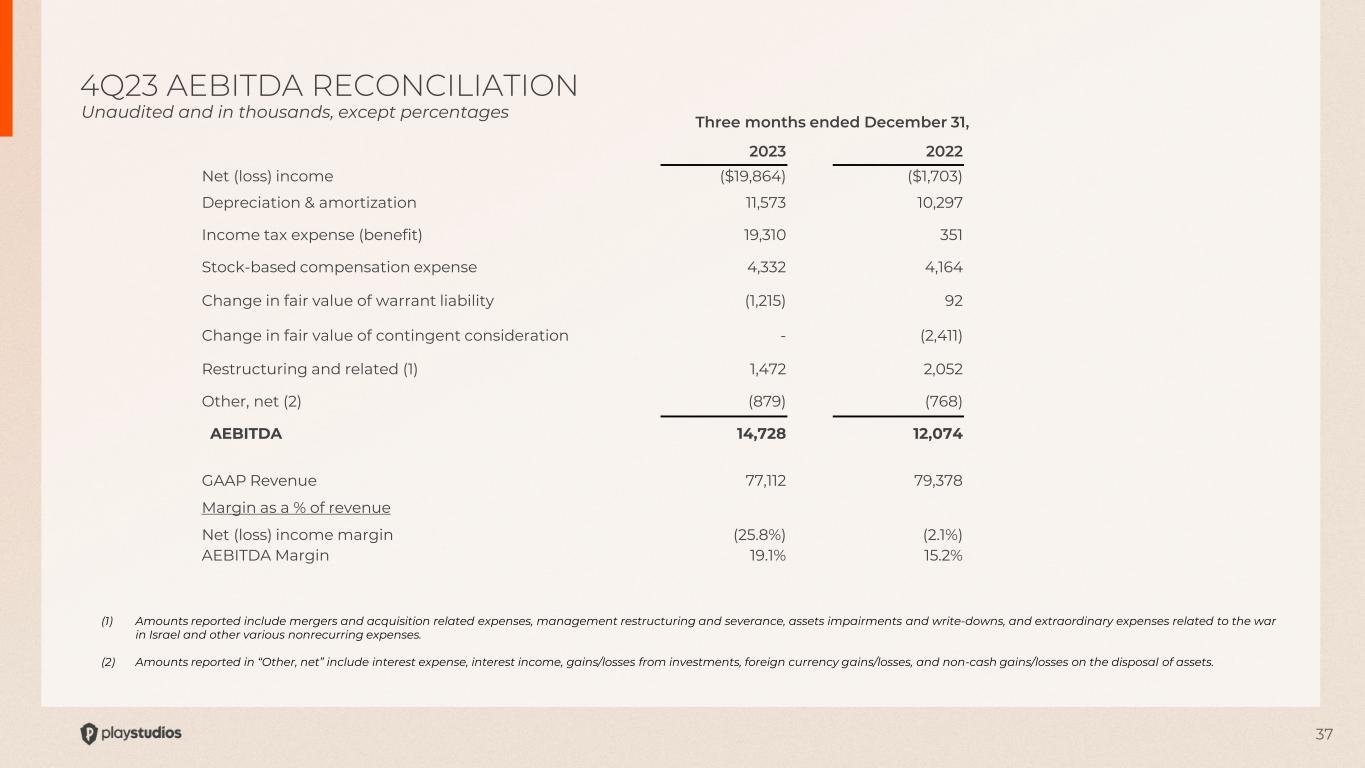

37 (1) Amounts reported include mergers and acquisition related expenses, management restructuring and severance, assets impairments and write-downs, and extraordinary expenses related to the war in Israel and other various nonrecurring expenses. (2) Amounts reported in “Other, net” include interest expense, interest income, gains/losses from investments, foreign currency gains/losses, and non-cash gains/losses on the disposal of assets. 4Q23 AEBITDA RECONCILIATION Unaudited and in thousands, except percentages Three months ended December 31, 2023 2022 Net (loss) income ($19,864) ($1,703) Depreciation & amortization 11,573 10,297 Income tax expense (benefit) 19,310 351 Stock-based compensation expense 4,332 4,164 Change in fair value of warrant liability (1,215) 92 Change in fair value of contingent consideration - (2,411) Restructuring and related (1) 1,472 2,052 Other, net (2) (879) (768) AEBITDA 14,728 12,074 GAAP Revenue 77,112 79,378 Margin as a % of revenue Net (loss) income margin (25.8%) (2.1%) AEBITDA Margin 19.1% 15.2%

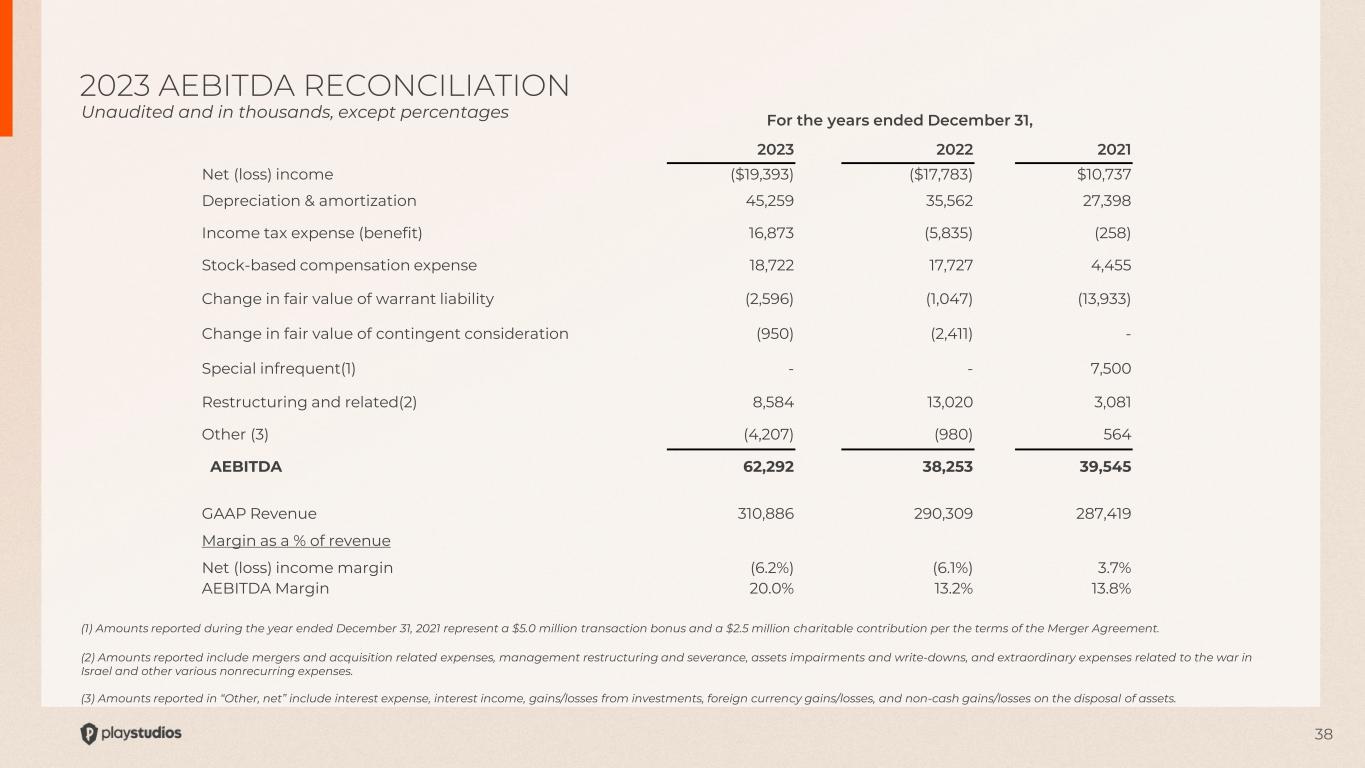

38 For the years ended December 31, 2023 2022 2021 Net (loss) income ($19,393) ($17,783) $10,737 Depreciation & amortization 45,259 35,562 27,398 Income tax expense (benefit) 16,873 (5,835) (258) Stock-based compensation expense 18,722 17,727 4,455 Change in fair value of warrant liability (2,596) (1,047) (13,933) Change in fair value of contingent consideration (950) (2,411) - Special infrequent(1) - - 7,500 Restructuring and related(2) 8,584 13,020 3,081 Other (3) (4,207) (980) 564 AEBITDA 62,292 38,253 39,545 GAAP Revenue 310,886 290,309 287,419 Margin as a % of revenue Net (loss) income margin (6.2%) (6.1%) 3.7% AEBITDA Margin 20.0% 13.2% 13.8% (1) Amounts reported during the year ended December 31, 2021 represent a $5.0 million transaction bonus and a $2.5 million charitable contribution per the terms of the Merger Agreement. (2) Amounts reported include mergers and acquisition related expenses, management restructuring and severance, assets impairments and write-downs, and extraordinary expenses related to the war in Israel and other various nonrecurring expenses. (3) Amounts reported in “Other, net” include interest expense, interest income, gains/losses from investments, foreign currency gains/losses, and non-cash gains/losses on the disposal of assets. 2023 AEBITDA RECONCILIATION Unaudited and in thousands, except percentages